Economy and demographics

The economic outlook for the Netherlands has improved strongly in recent times. Forecasts show that the Dutch economy is set to book healthy growth of around 2.0% per year. Employment levels are also set to rise by approximately 1% annually, while consumer confidence is higher than a year ago. Persistently low inflation is expected to boost consumer spending more than 1.5% annually. The improved economic outlook sets a solid foundation for the Dutch real estate market.

Strong demand for Dutch investments

In addition to increasing interest from Dutch investors, the amount of foreign capital from international investors has grown dramatically in recent years. In fact, the majority of real estate investments in the Netherlands now come from international investors. While real estate prices in other key markets, such as London, Paris and Munich have already returned to or even risen above pre-crisis levels, Dutch real estate is still attractively priced. However, the continuing interest of both Dutch and international investors is quickly pushing up the prices of prime assets. This trend is expected to continue in the coming years, and investors are likely to switch their attention to secondary markets due to the shortage of prime real estate.

Urbanisation and ageing will be key factors

On a national level, both the total population and the number of households are expected to continue to grow in the coming decades. The total population and the number of households are expected to continue growing until 2040, stimulating overall consumer spending. The current population is expected to increase from 16.9 to 17.2 million, while the number of households is set to rise from 7.7 to 8.0 million by 2020. Demographic growth, however, will be focussed primarily on the core regions in the Netherlands due to ongoing urbanisation, as people relocate to cities and regions with a good economic outlook and rising employment.

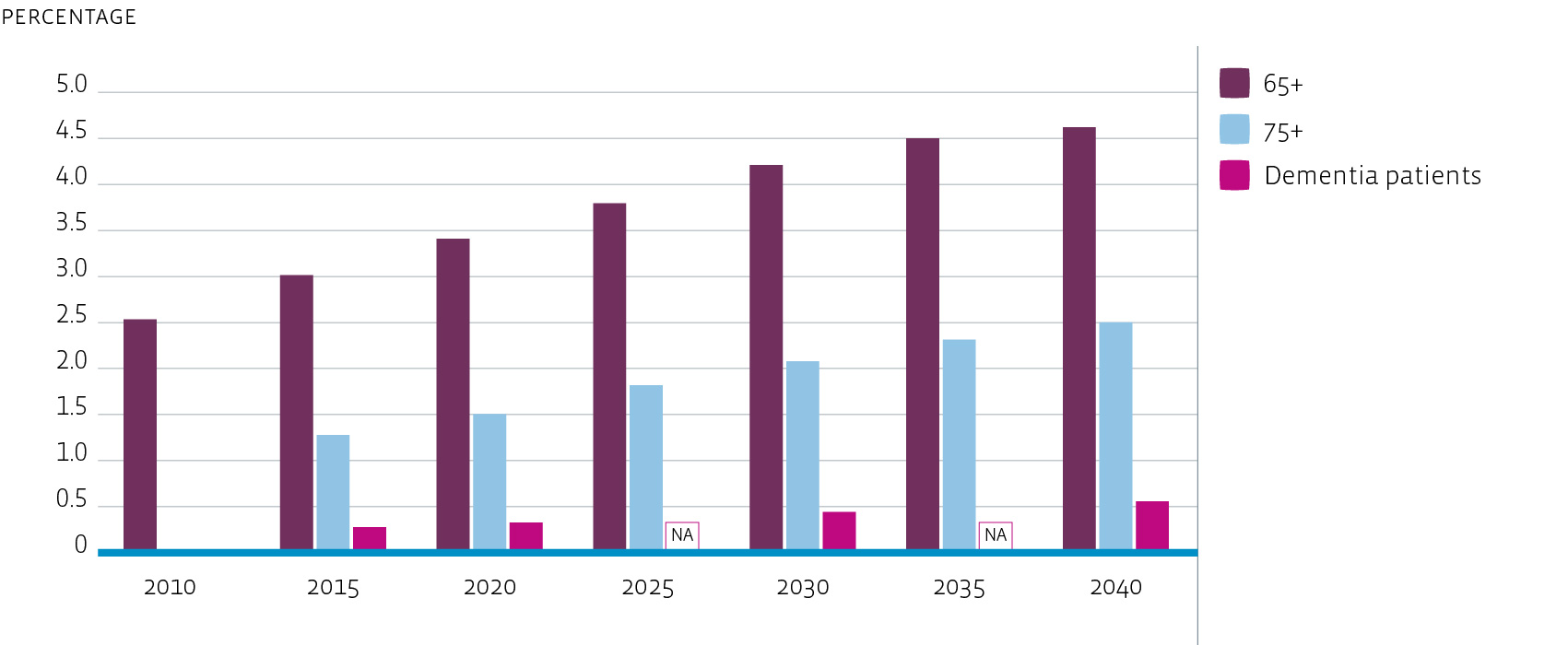

On top of this, the average age of the Dutch population continues to increase. The number of people older than 75 years is expected to double in the next 25 years. Elderly people currently represent 19% of the total population and this is expected to increase to 27% by 2040. This increase will be driven in particular by the rise in the number of people reaching the age of 80 years and older, as this group is expected to increase by some 54% in the years to 2050. This phenomenon is also known as the ‘Double Ageing of the population’. This is set to result in a rise in the number of people suffering from dementia, which will in turn increase the demand for assisted living and other care facilities.

Increase of elderly and dementia patients

Trends and developments in the Healthcare market

Need to preserve healthcare capacity

Both urbanisation and ageing will have a major impact on quantitative and qualitative demand for housing in the coming decades. Due to stable population growth, the ageing population and the expected rise in the number of Alzheimer patients, the demand for healthcare in the Netherlands will show very stable growth in the coming decades. Despite the fact that budget cuts are forcing many local authorities to limit their healthcare spending, we are seeing certain local authorities anticipating future growth. While they are unable to support an expansion of supply at this time, they are at least willing to think about preserving current capacity.

Strong increase of future demand for healthcare

The Netherlands will see a ‘double aging’ over the next few decades: not only is the number of people over 65 increasing, life expectancy is also increasing (50% of Dutch females born today, will reach the age of 100). This ageing, in combination with a strong increase in the number of people with dementia, will result in a major increase in demand for healthcare, in both the cure and care sectors. Finally, the mentally disabled are also living longer lives. Although this segment is not growing, it is expected to be very stable over the next few decades.

Government policy: separation of housing and care

In the course of the last two years, people who are classified as in need of ‘lighter’ care (ZZP 1-3) are no longer entitled to state-funded residential care. They now have to finance that themselves, and they receive the necessary care in their own home. This measure has led to a drop in the number of homes for the elderly, as they are not fit to meet modern demands. Simultaneously, there has been a strong increase in the construction of private care facilities, which offer both suitable housing, care and welfare.

Growing healthcare real estate market is maturing

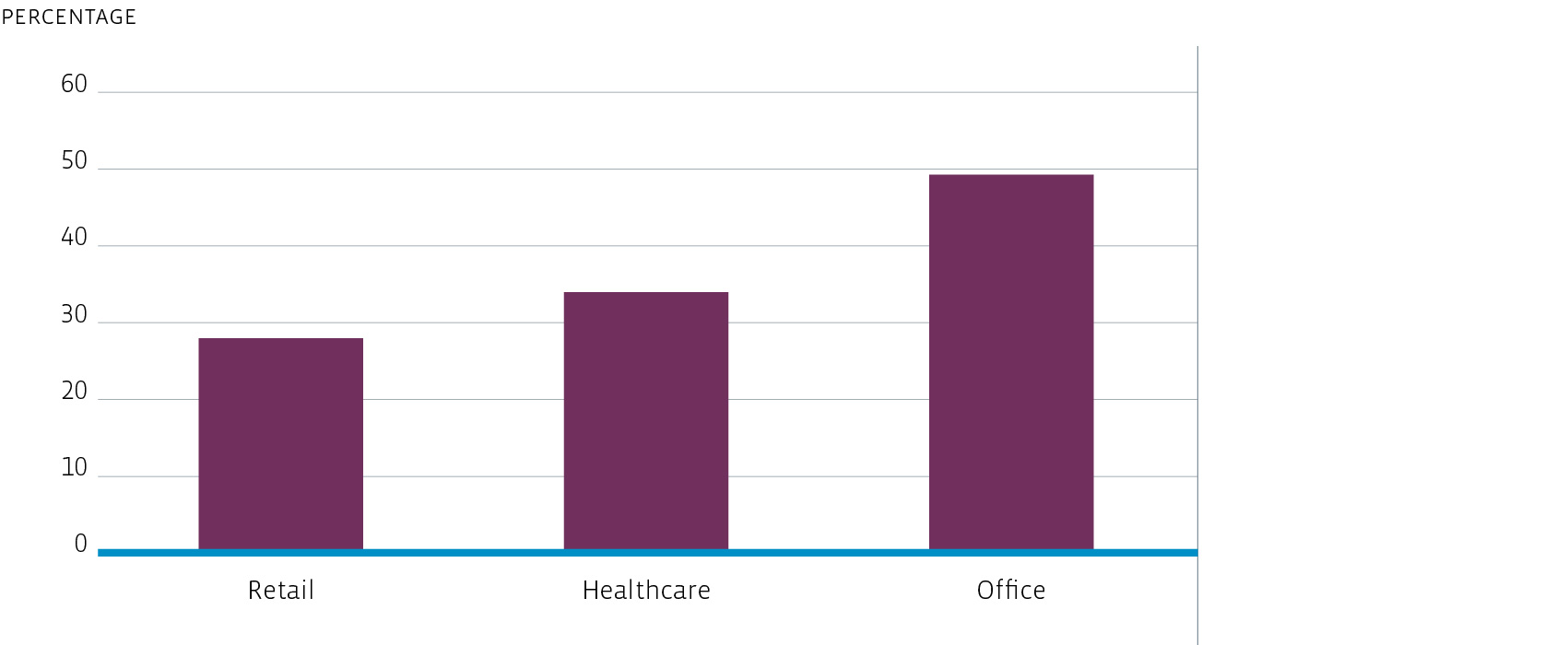

The cure and care markets together currently occupy an amount of floor space somewhere between the retail market and the office market. Current estimates put this floor space at around 30 million m² for the care segment alone by 2030. Most of this will be interesting for institutional investors. DTZ and CBRE are predicting annual volume of between € 650 – 800 million over the next five years.

Even without the regulatory changes in the healthcare market, there are already major shortages of suitable housing. The Dutch state commission for the living environment and infrastructure (Raad voor de leefomgeving en infrastructuur) has concluded that each year some 12,000 new elderly and disabled people will not be able to find a suitable home. This points to a drastic shortage of suitable accommodation and a sustained demand for high-quality healthcare real estate.

Growing shortage on top of current shortage (source: Actiz/WooN2012)

| | 2006 | 2009 | 2012 |

Assisted Living | -48,000 | -40,000 | -10,000 |

| | | | |

Other suitable residences for old age | -92,000 | -84,000 | -109,000 |

Housing with services | -49,000 | -41,000 | -46,000 |

Other elderly services | -43,000 | -43,000 | -63,000 |

| | | | |

Current shortage | -140,000 | -124,000 | -149,000 |

Size of real estate markets in mln m² (2014, source EIB)

Care for the mentally disabled

This segment has great deal of investment potential because healthcare providers need to replace their housing facilities. Although this segment is not (or at least less) influenced by the ageing trend, there is a constant need for ‘beds’, which is expected to remain stable at a level of 75,000 beds for intramural care in the coming years.

Increasing diversity in the market

The fact that a large group of clients is now responsible for their own accommodation means that they have the freedom to live wherever they want – these clients receive care services at home. This freedom of choice is having a major impact on the market and we expect to see the emergence of a more diversified market. For example, people with higher living standards are expected to demand the same quality when they need care services. Also, people are expected to give location more weight in the choices they make.

Investors an accepted alternative to bank financing

In the past, healthcare institutions either rented property from housing associations, or they invested in real estate themselves. As their real estate costs were guaranteed by the government, bank financing was fairly straightforward. This guarantee has now been removed and it is more difficult to obtain bank loans. Renting real estate has proved to be a good alternative, which has opened the field to institutional investors, which are now expected to play an increasingly significant role in the healthcare investment market.

Housing associations reluctant to invest

Due to government reforms, housing associations are now cutting back on their healthcare real estate services and focus only on the social segment. This is again creating space for alternative players on the market, including institutional investors.

Healthcare market as investment grade real estate

In the spring of 2015, the Economic Institute for the construction industry (EIB) published a research paper on investment opportunities in the healthcare real estate sector. The conclusions of this paper included a number of criteria an investment in healthcare real estate would have to meet to qualify as investment grade real estate:

The property is part of a market with a certain scale in which buildings have comparable features and comparable economic exposure (the same legislation and regulations). The property should also be distinctive when compared with other investments (in real estate).

A large (potential) market contributes to marketability, which means that real estate is more easily traded.

The property (or the portfolio of properties) should be of sufficient volume in itself to be an interesting investment for investors.

The housing regime must provide the freedom (both physical and policy-wise), to enable the reasonable commercial exploitation of the property and to be able to transform same if necessary.

The property should not be too large, as this would be too dominant (temporarily) from a portfolio point of view. Too large a property would also entail extra risks, for instance related to its potential transformation.

Limited government influence on the cash flow due to consistent policy, for instance due to a major share of self-financed payments by healthcare clients.

Finally, a solid tenant is required, both by private individuals and by care providers. This reduces the risk of vacancy, which in turn makes the real estate a more attractive investment.

The paper concluded that part of the healthcare real estate supply in the Netherlands now qualifies as investment grade assets. It also noted that the most attractive real estate for investors will be in the larger cities, due to the high demand generated by the ageing urban population. The EIB recommended the construction of more clinics, assisted living facilities and retirement homes as these are attractive for institutional investors and in order to meet the expected growth in demand from elderly people.

Institutional market maturing slowly

Outside of housing associations, there are currently very few investors active on the healthcare investment market. Historical return series are distorted by the negative returns generated by housing associations, so historical series are therefore not representative. At this point in time, the healthcare investment market is still in its infancy, but it is expected to mature in the near future. Healthcare investments will become a valuable alternative for institutional investors, with the current size of 34 million m² - the same size as the retail market - set to increase to 51 million m² in 2030, taking it to the current size of the office market. Given the steady increase in demand beyond that point, the healthcare market is expected to easily outstrip the office market by 2040.

Brief summary of the Dutch Healthcare market

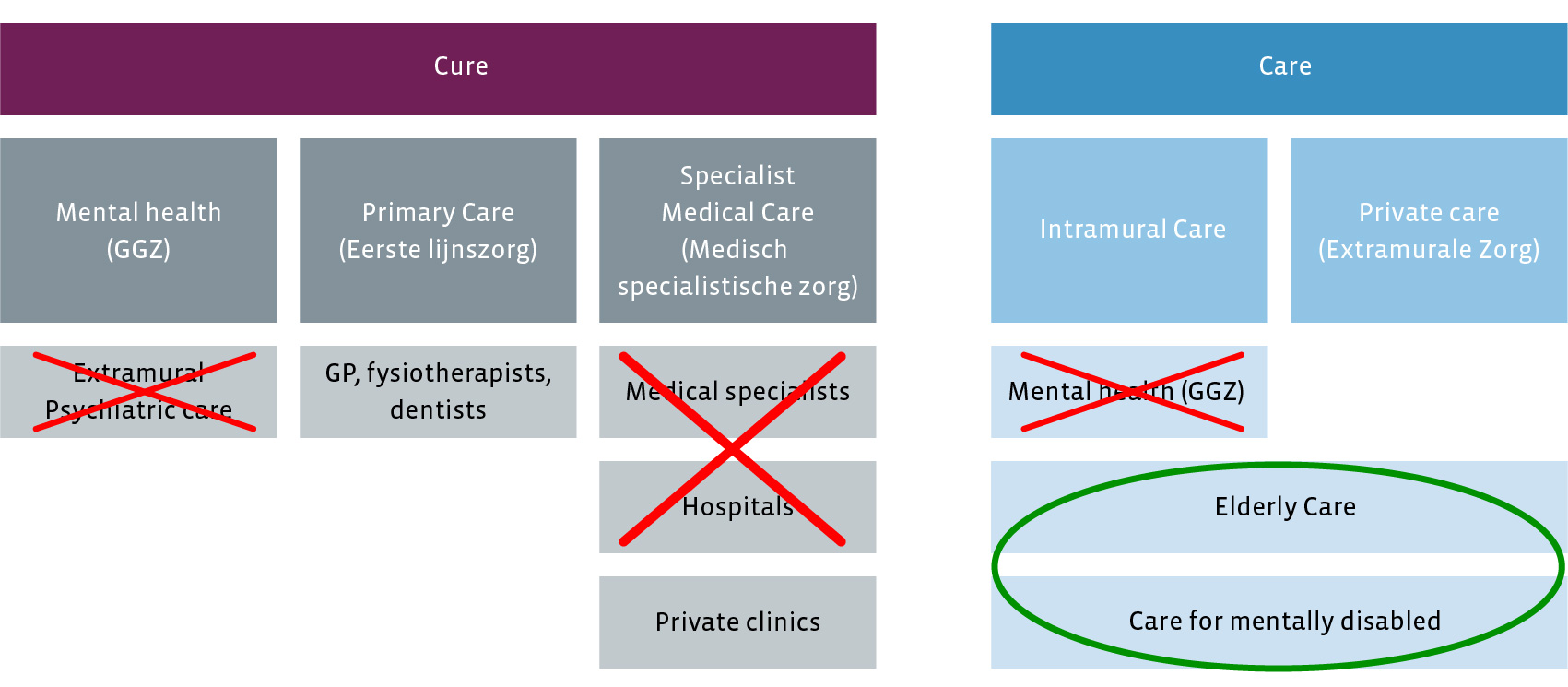

Distinction between Cure and Care

The Dutch healthcare market is usually split into two areas. The first is the ‘cure’ market, aimed at curing people in the short term. Financing comes from every person of 18 years and older in the Netherlands, through their healthcare insurance. The insurance companies pay for any medical treatments, with the exception of the obligatory own-risk deduction. The second is the care market, which is aimed at providing support for people who need help to take care of their own basic needs (elderly people and the mentally disabled). A large part of the costs related to this assistance is considered ‘uninsurable’, which means the Dutch Government finances this type of care (Intramural care). The costs are covered by premiums people pay through their taxes.

Focus areas for the Fund

“Separation of housing and care” (extramuralisation) creates ‘regular’ housing market

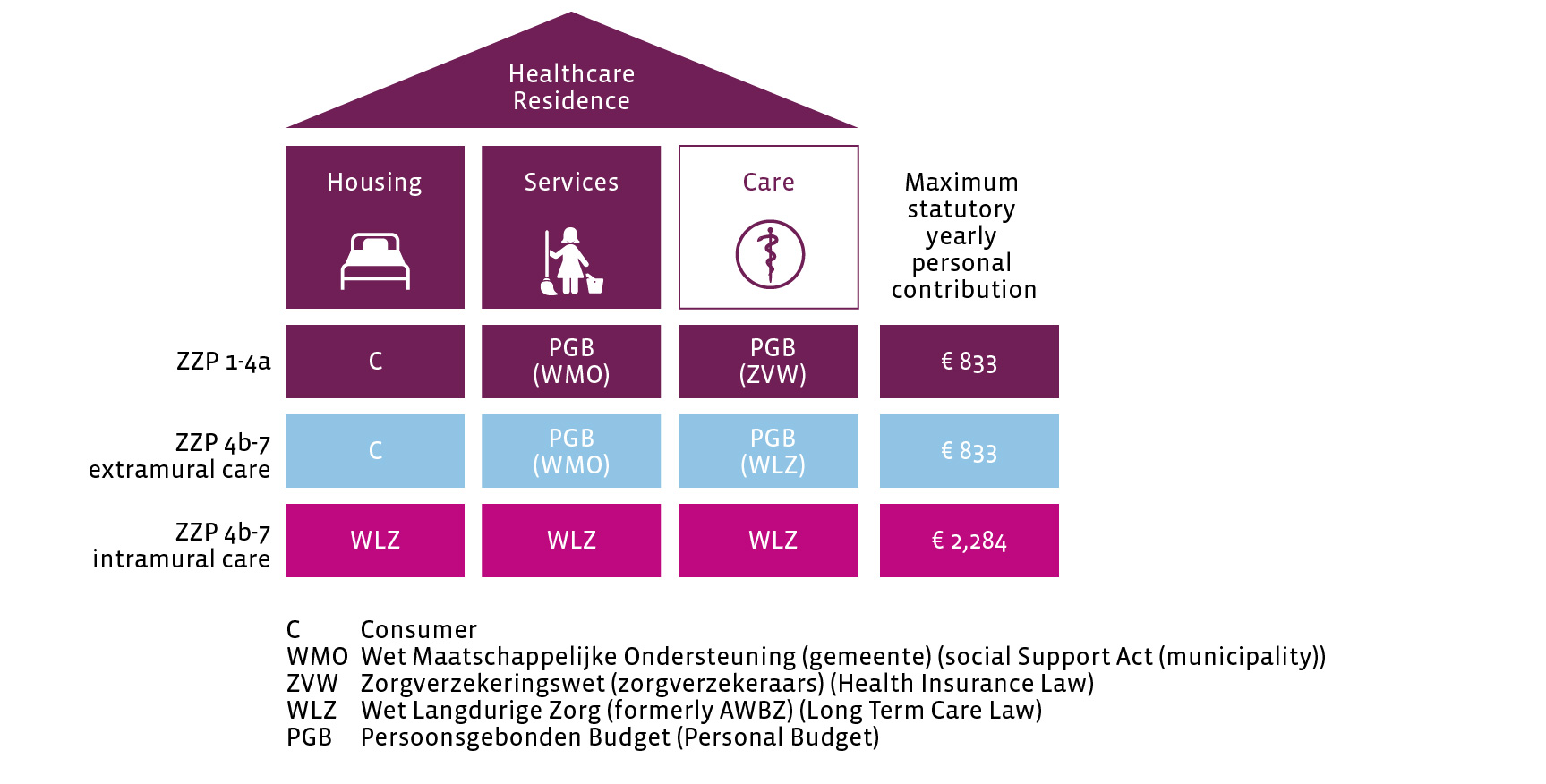

As of 2013 and 2014, the government no longer pays for the housing of elderly people who require care (but can still live independently), and the compensation for domestic aid has been drastically reduced. Technically, the categories ZZP 1 through 3 have been eliminated (and 4a followed as of 1-1-2016; this covers approximately 25% of total ZZP 4 indications). ZZP stands for Zorg Zwaarte Pakket, which is a financing package for an individual’s care, housing and services. As of 2013, the government only finances the care element of this package. Housing costs are considered regular costs, which people now have to pay themselves. This means that only the care component is influenced by government measures. Housing fees are therefore not affected by government measures (or at least no other measures than those that apply to the ‘regular’ housing market). Finally, people who receive care need to pay a statutory personal contribution of up to € 833 per month, depending on their income and assets.

Care financing structure has changed

In addition to the separation of housing and care, the financing structure has changed: the national government has made local governments and healthcare insurers responsible for financing the care for ZZP 1 through 4a. Nothing has actually changed for ZZP 4b and up, and no fundamental changes are expected, as these categories represent intensive care for dementia, mentally disabled people and bedridden patients (and other care, such as medical rehabilitation and palliative care, which are outside the scope for the Fund). Here also an income related statutory personal contribution is due, up to € 2,300/month.

Who pays what in healthcare residences