Bouwinvest believes it has a responsibility to make sure its investments meet sustainability criteria and that we operate in a responsible and ethical manner. We have always taken a long-term view and environmental, social and governance criteria play a significant role in our investment strategy. This is because we are convinced that sustainable and socially-responsible investments and business operations play a key role in helping us to book stable returns from our real estate investments.

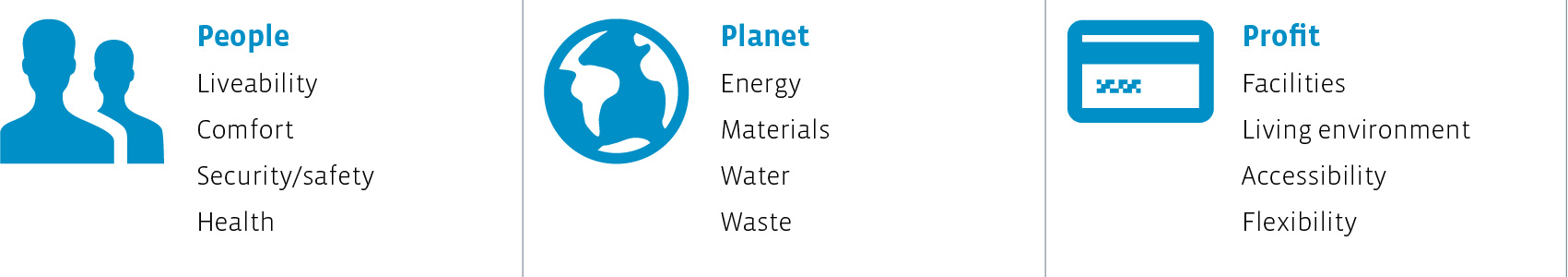

In 2015, Bouwinvest continued to integrate CSR in its business operations and divided its CSR mission and activities into three pillars.

Our CSR pillars

We aim to be a reliable business partner and meet the expectations of our investors through full transparency on our CSR track record and goals.

We endeavour to continuously improve the sustainability of our investment portfolio in cooperation with all our stakeholders.

We aim to be a flexible, ethical and fair employer to help our people to achieve Bouwinvest’s ambitions.

In line with Bouwinvest’s CSR pillars, the Residential Fund’s sustainability strategy is focused on increasing the sustainability performance and attractiveness of its residential assets. Not only does this boost the long-term performance of the Residential Fund’s assets, it also increases the total value of the Fund’s property portfolio and creates financial and social value for all stakeholders.

Building value

Bouwinvest considers investments in sustainability from a business perspective. Energy-efficiency measures improve the competitive position of the Fund’s residential properties and add value for our stakeholders, both investors and tenants. However, Bouwinvest’s sustainability strategy extends beyond energy use to the social aspects of sustainability, such as investments to upgrade local public amenities and create a pleasant living environment.

We build value by addressing those issues that are important and relevant to our stakeholders, both tenants (such as comfort, energy use, materials and indoor climate) and investors (such as risk, returns, governance, stability and transparency). We engage them in constructive dialogues.

Focus on material topics

The focus of the Residential Fund’s sustainability strategy is on reducing the environmental impact of its properties while enhancing comfort in cooperation with its tenants and other stakeholders. For example, our standard programme of requirements for acquisitions and renovations focuses on structural quality, energy-efficient installations, water-saving fittings and maintenance-friendly and recycled materials. We have limited control in terms of influencing and measuring energy, water and waste reductions at tenant level, so we focus on data collection of sustainability indicators in areas that we can control.

Scope | Tool | Targets |

Fund | GRESB | Outperformance of the benchmark and retain Green Star status |

Asset | EPC labels, sustainable programme of requirements | Generate insight into current performance and reduce operational costs, improve the quality of assets |

Tenants | Ezie | Increase sustainability awareness among tenants, with a focus on energy use; cooperation with tenants: education and awareness |

Property managers | Contracts and meetings | Active cooperation to achieve CSR targets |