Portfolio composition at year-end 2015:

A total of 42 properties across the Netherlands

205,513 m² of lettable floor space

Total value investment properties € 719.1 million

Diversification guidelines and investment restrictions

As per 1 January 2016, the new diversification guidelines are applicable. Therefore the current portfolio as per 31 December 2015 is compared with the current diversification guidelines and investment restrictions.

Diversification guidelines | Current portfolio | Conclusion |

≥ 80% of investments invested in high street or shopping centres | 94.3% in high street and shopping centres | Compliant |

≥ 90% of investments invested in low or medium risk categories | 95.3% in low and medium risk | Compliant |

Investment restrictions when the total investments of the Fund are > € 750 million | | |

< 15% invested in single investment property | There is one investment property exceeding 15% (*) | N/A |

< 10% invested in non-core (non- retail) properties | All the investments are in retail | Compliant |

< 15% (re)development activities and: | Investments under construction are 26.8% (*) | N/A |

- only assets that are part of the Fund | The assets are property of the Fund | Compliant |

- only assets that are optimising the quality of the portfolio | The investments upgrade the retail assets | Compliant |

- no negative impact on the diversification | Increase of 2.2% to a total of 94.3% high street retail and shopping centres | Compliant |

- signed intents relating to at least 60% of the rental income | > 80% signed intents | Compliant |

No investments that will have a material adverse effect on the Fund’s diversification guidelines. | There have been no investments in 2015 that have a material adverse effect on the Fund's diversification guidelines | Compliant |

- *The total value of investment property in the Fund is € 719.1 million so the restriction is not yet applicable.

Investments, divestments and (re)developments

Due to the various ongoing and completed redevelopments, 2015 was a year of optimisation. The Fund invested a total € 63.9 million in new development and redevelopments, which helped take the total value of the portfolio to € 719.1 million. All the new-delivered and redeveloped assets bolster either the ‘Experience’ or ‘Convenience’ portfolios.

New assets in the portfolio

Parkweide, Ede

The Parkweide shopping centre in Ede-Noord opened its doors in June 2015. Parkweide is a retail development, acquired in 2014 as turn-key acquisition, in a green area to the north of Ede, close to several smaller towns and to road and other transport links. The centre offers 5,400 m² of gross lettable area and is anchored by two large supermarkets (Albert Heijn and Aldi). It also offers a range of other retail units providing daily groceries and other necessities. Parkweide has very generous parking facilities, with space for no less than 200 cars, adding another level of 'convenience' to the centre.

Completed redevelopments

Nieuwendijk 196, Amsterdam

Bouwinvest completed the redevelopment of Nieuwendijk 196 after two years of construction work. The complex is a true eye-catcher, with its impressive new glass façade. The 5,200 m² complex has been rented by two high-fashion international retailers. The main tenant is Zara with a 3,000 m² store. In 2014, the Fund allready signed a lease contract with JD Sports for the remaining 2,200 m² of retail space. The redevelopment of Nieuwendijk 196 is a major upgrade of a highly popular shopping destination.

Westerhaven, Groningen

This large-scale redevelopment has given new momentum to the Westerhaven shopping centre in Groningen. The current shopping centre includes over 14,000 m² of retail space and a parking garage for 800 cars. Westerhaven comprises a traditional shopping street with tenants such as C&A, Hema and Kruidvat and a two-floor building with large-scale retail spaces. In 2015, the Retail Fund signed a long term lease lease with international retailer Primark for 7,000 m² of retail space in Westerhaven. The new store will be the only Primark in the northern part of the Netherlands and is expected to act as a major draw for both consumers and other retailers. Also in 2015, the Dutch electronics retailer Media Markt signed a new lease for 5,500 m² store in the Westerhaven shopping centre, relocating this current tenant.

Redevelopment investments

Damrak 70, Amsterdam

In 2015, the Fund invested € 21.3 million in the redevelopment of Damrak 70, located in the heart of Amsterdam. The redevelopment has made substantial progress. C&A has signed a lease for over 8,000 m² of retail space, while Primark has agreed to lease 8,800 m². Starbucks has already opened a store at Damrak 80/81, which is also part of the redevelopment. Building activities started in March 2014 and the renewed Damrak 70 is set to open in Q2 2016.

Goverwelle, Gouda

The Fund is investing in the upgrade and expansion of the Goverwelle shopping centre. The 1,000 m² extension will create space for the expansion of the Albert Heijn supermarket and for a second supermarket, plus additional parking facilities for 235 cars. Bouwinvest expects to complete this redevelopment in 2017.

Molenhoekpassage, Rosmalen

To maintain the high quality of this successful shopping centre for daily goods and reduce the risk of vacancy, the Fund is upgrading and updating the look and feel of this centre and adapting the division of retail spaces to the demands of the current tenants. The Albert Heijn supermarket will be adding over 400 m² to its current retail space and we are improving the routing within the centre. Thanks to these changes, combined with the arrival of a second supermarket (Aldi) nearby, the Fund expects Molenhoekpassage to retain its strong market position in Rosmalen, part of the city of Den Bosch. The Fund expects to complete the current redevelopment at the end of 2016.

Development investments

Stadionplein, Amsterdam

The Fund is developing an eye-catching multi-use complex in the historic district of Amsterdam-Zuid, near the 1928 Olympic Stadium. The new development will include 4,500 m² of retail space and will be a very distinctive addition to the neighbourhood, thanks to its much larger shops, especially the Albert Heijn supermarket, and its superb access by road and public transport. The shopping centre will open in 2016 and will focus primarily on healthy foods, anticipating the growing demand for this type of product in its high-end catchment area.

Mosveld, Amsterdam

The Fund acquired the Mosveld shopping centre in the revitalised and restructured southern neighbourhood of Amsterdam-Noord. This centre has a substantial and growing catchment area, thanks to the ongoing transformation of this former harbour area, including numerous residential and cultural developments. The 7,700 m² Mosveld shopping centre will focus on daily goods. With two modern supermarkets as anchor stores (Albert Heijn and Deen), a central location in the neighbourhood and its own parking area, the centre offers all the convenience the Fund demands. Opening is planned for 2016.

Divestments

Assets that do not fit our strategic requirements regarding experience or convenience because of their location, size or economic outlook will be sold. In line with these divestment criteria, we concluded a partial sale of Achterdoelen in Ede in 2015. This divestment involved a single retail unit of approximately 413 m² of retail space on Arnhemseweg.

Divestment

Asset | City | m2 |

Arnhemseweg (part of Achterdoelen) | EDE | 413 |

Optimising the risk-return profile

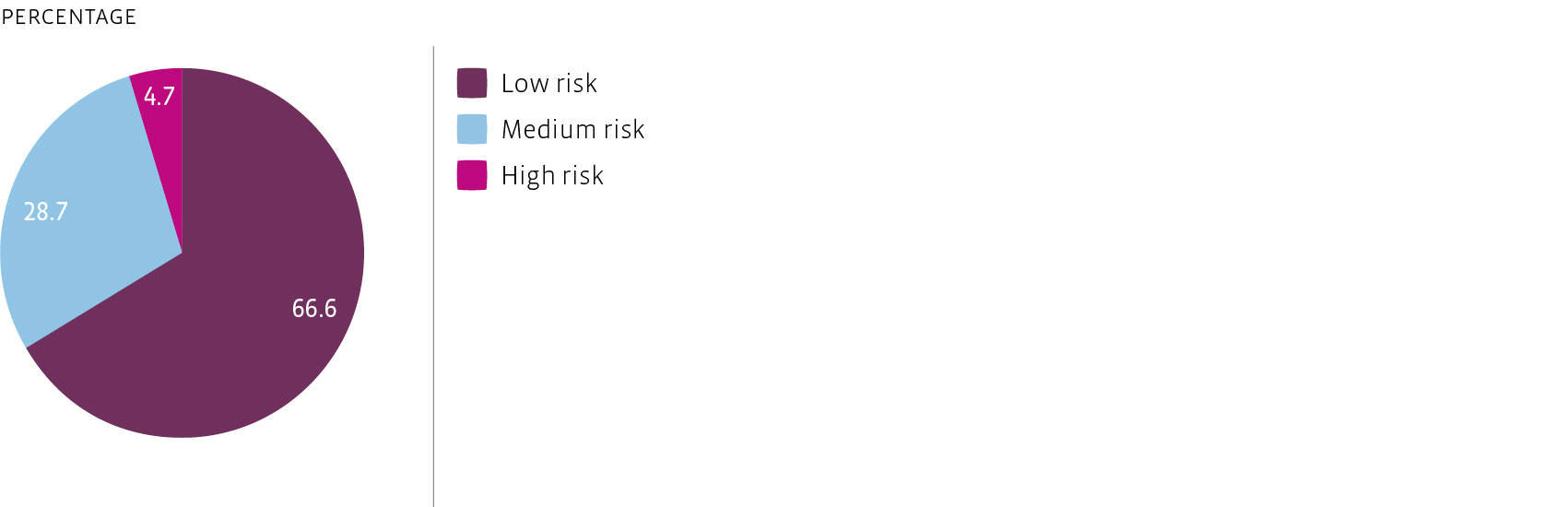

In terms of risk diversification, at least 90% of the investments must be low or medium risk. The actual risk allocation at year-end 2015 is shown in the figure below. In 2015, the proportion of low-risk investments decreased to 66.6% from 76.2% due to market developments.

Portfolio composition by risk category based on book value

Active asset management

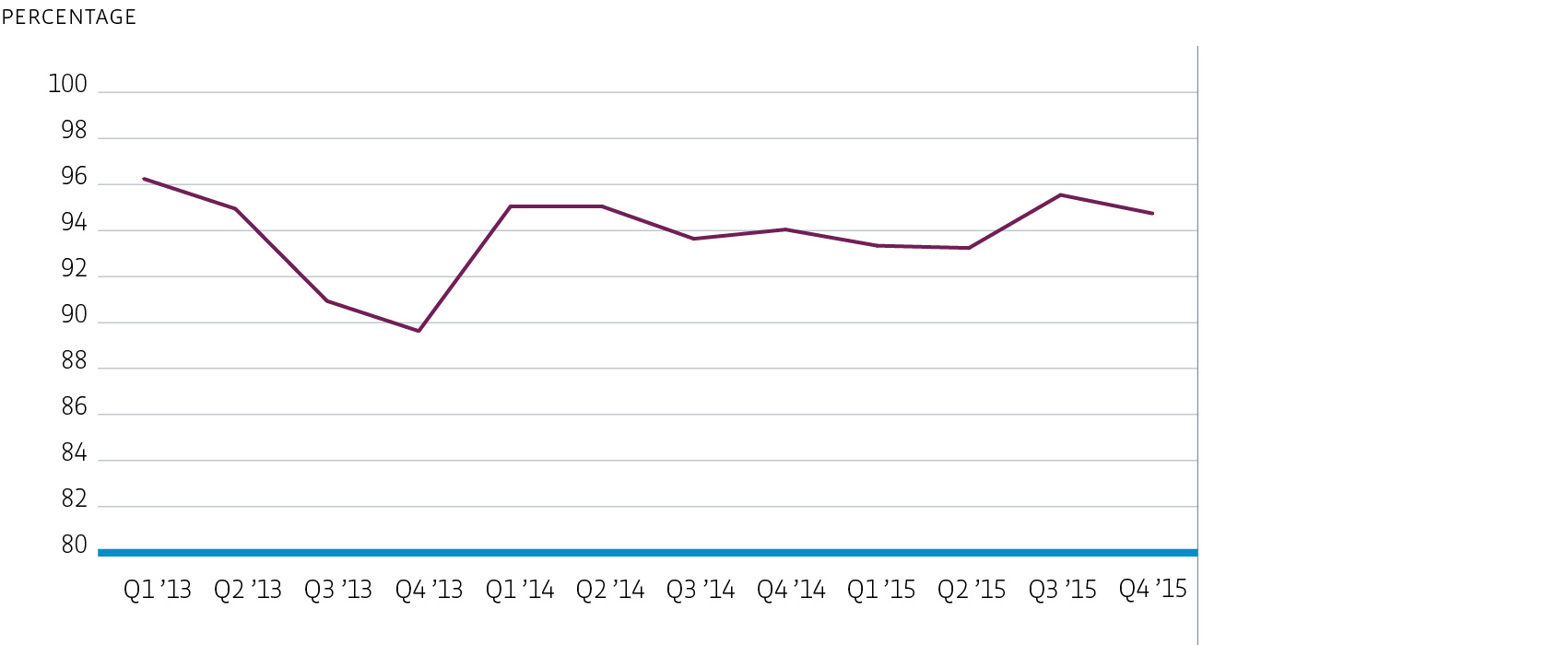

Financial occupancy

The retail market was once again challenging in 2015, with economic recovery still fragile but with a healthy economic growth and a slight recovery in consumer confidence. Thanks to highly active management of the portfolio, the Fund managed to maintain a high occupancy rate in 2015. The average financial occupancy rate for 2015 stood at 94.2% (2014: 94.4%).

Financial occupancy rate

Pro-active leasing

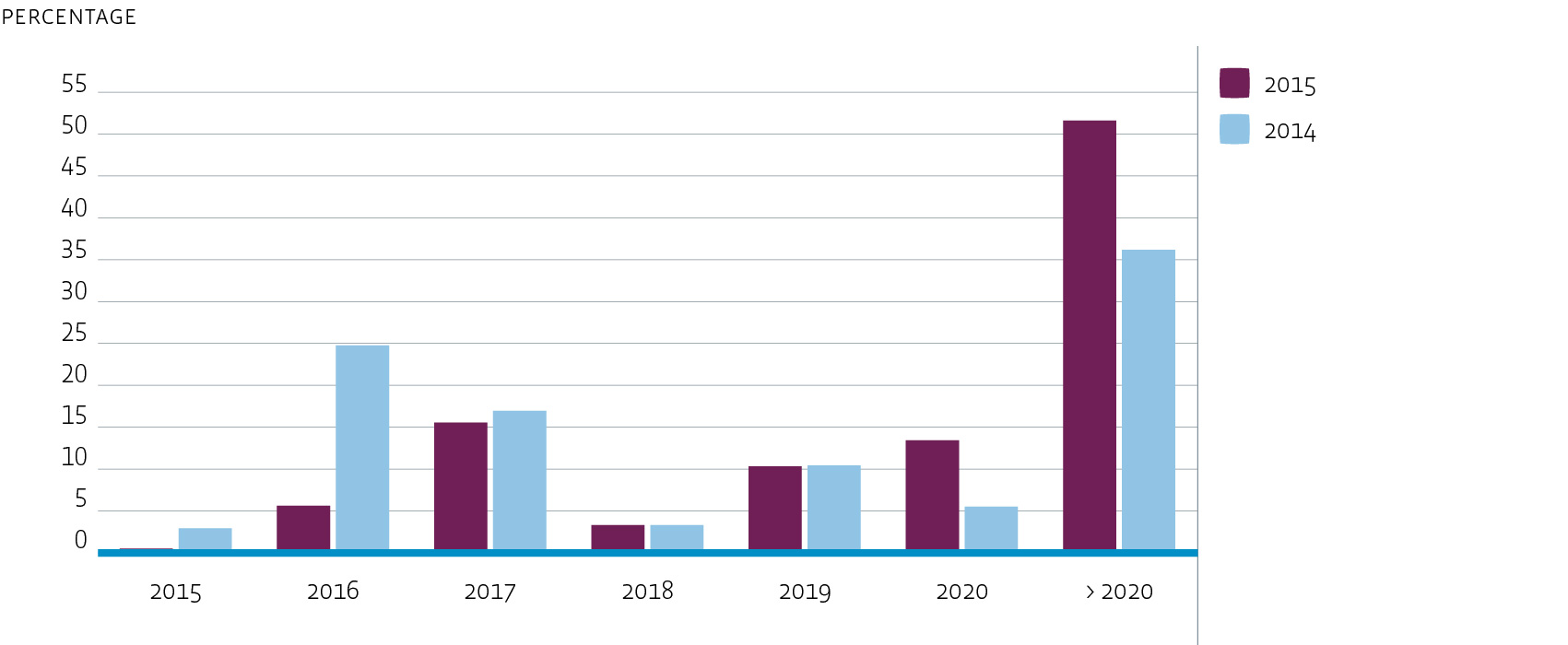

Lease contracts covering a total of 24,606 m² expired in 2015, and the Fund closed and extended leases for a total of 38,987 m² (€ 10.2 million per year). By the end of in 2015, more than 47% of the total rental income expires after 2020. This is a significant increase compared to 2014, the latter being due to long-term leases in Amsterdam (Zara and C&A) and Groningen (Primark).

Expiry dates as a percentage of rental income

Sustainable value

Bouwinvest also continued to improve the sustainability of the Fund, for example through the DUO energy labels for all the assets in the portfolio. These labels provide information and sustainability measures for both tenant and lessor. The Fund also sees redevelopment projects as the perfect opportunity to upgrade and enhance the sustainability of its assets, for instance by fitting solar panels and other measures. Making the Fund’s assets more sustainable helps to maintain or increase their value and improves their letting potential. As a result of the improved sustainability, the Fund was awarded GRESB Green Star status for the second successive year in 2015. We aim to retain this Green Star status in the years ahead and we will continue to implement existing initiatives and launch new ones to achieve our CSR ambitions.

Diversification

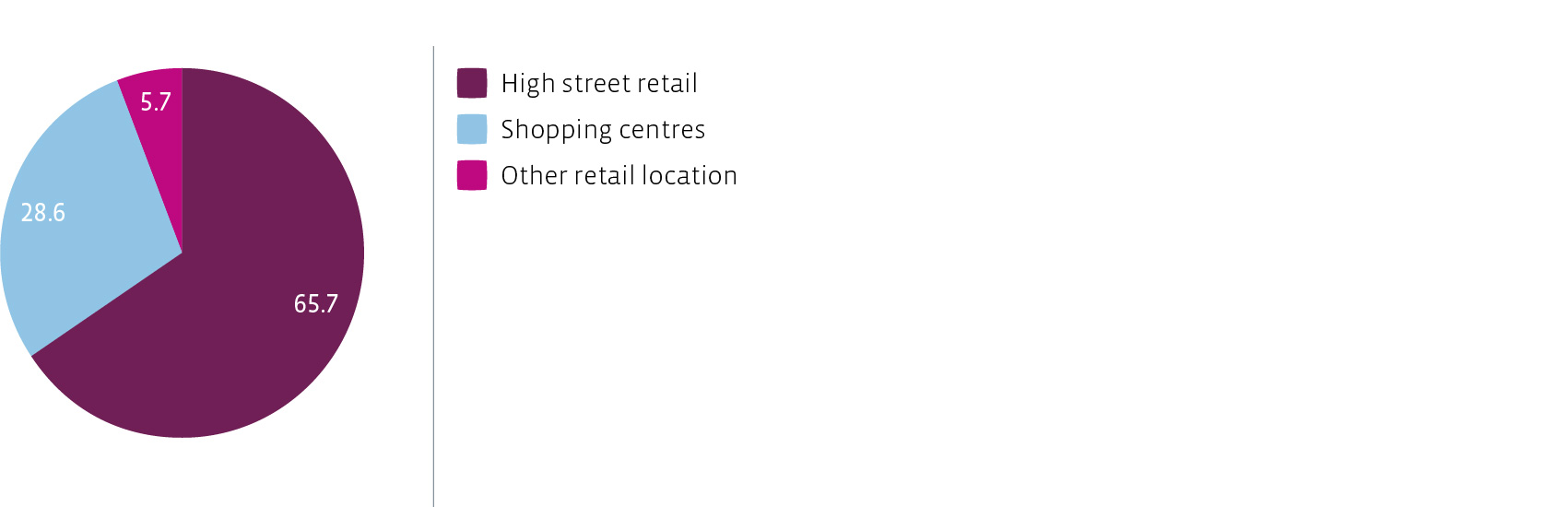

High street retail and District shopping centres

Capitalising on key market developments, the Fund focuses on high street retail units in major shopping cities and district shopping centres with a strong catchment area, easy access and a strong tenant mix. The target portfolio is divided into 70% high street retail and 30% shopping centres. Following investments and divestments during 2015, the share of high street retail decreased slightly to 65.7% in 2015 (2014: 66.2%). Future investments will bring the share of high street retail to 70%.

Portfolio composition by type of retail location based on book value

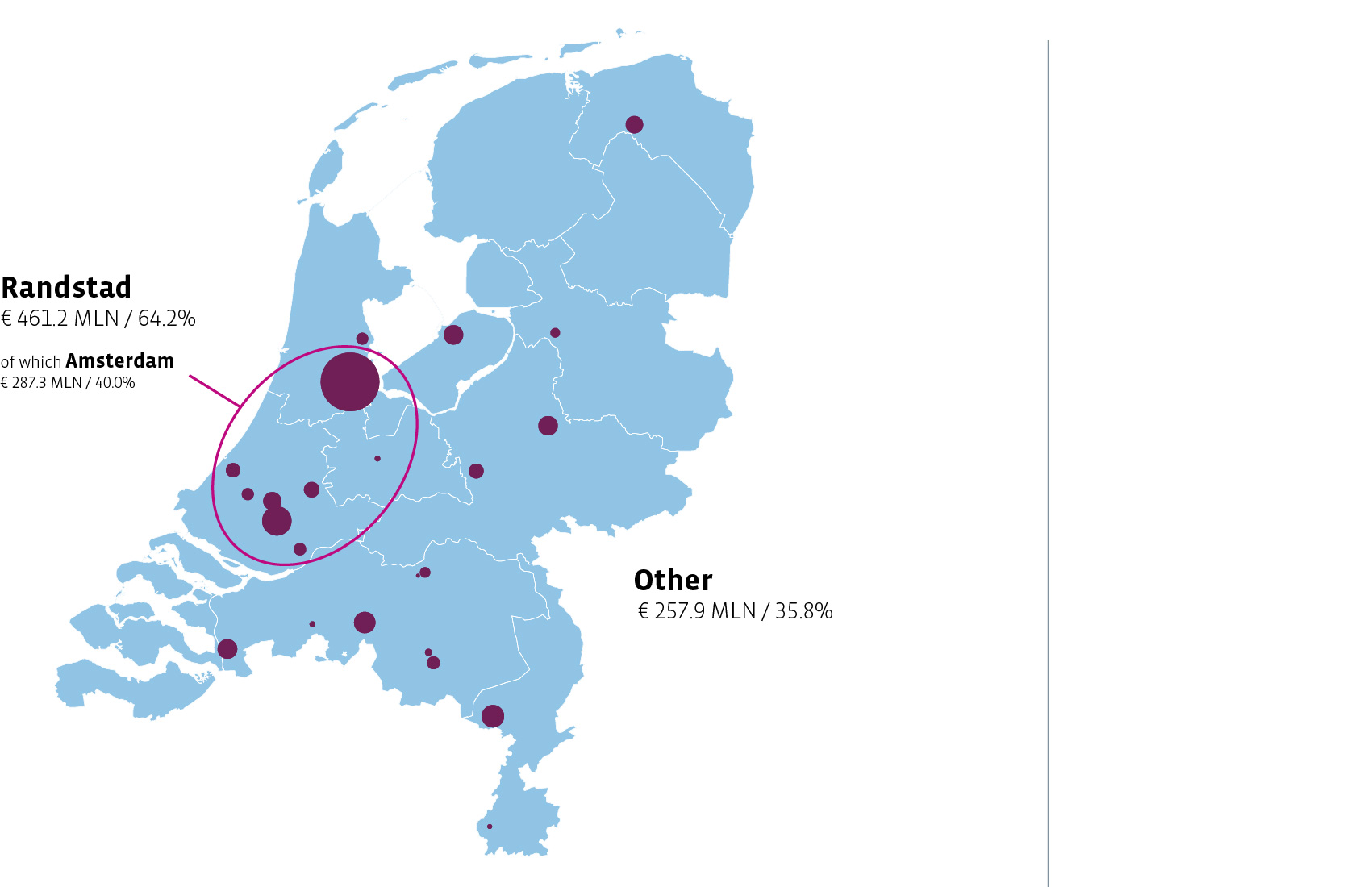

Regional spread of the Retail Fund portfolio based on book value

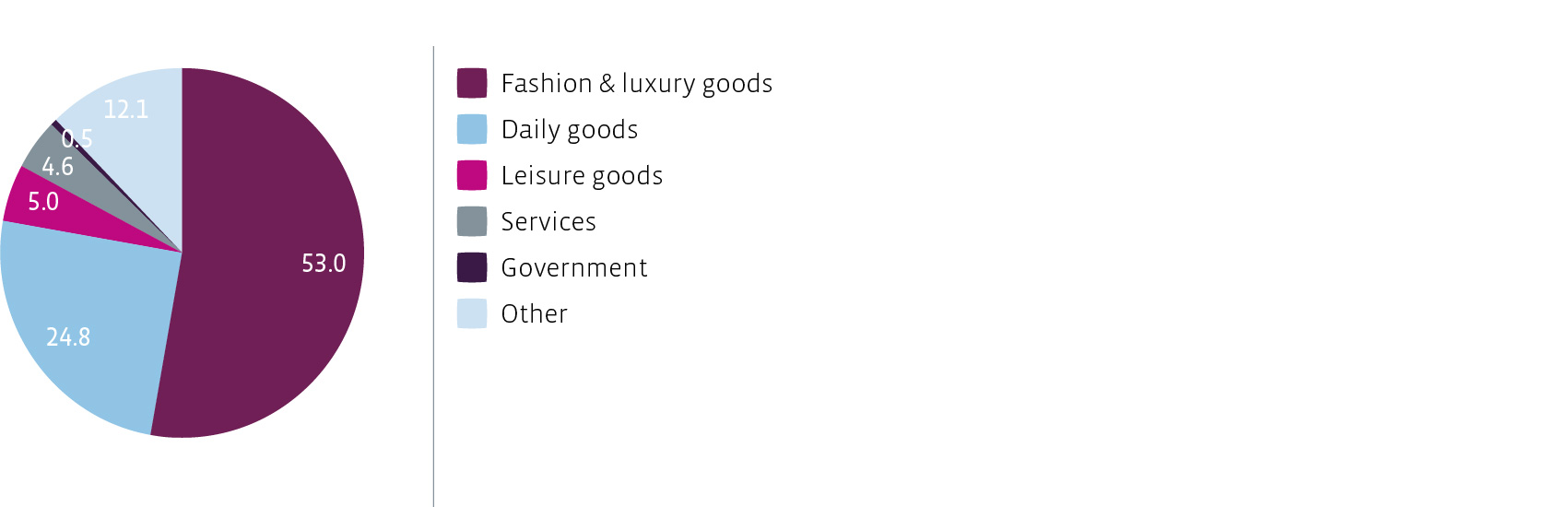

Tenant mix

The Fund’s portfolio includes a wide range of tenants by segment type. In 2015, the segments fashion and luxury goods increased to 53.0%, mainly due to investments and completed redevelopments. The segment ‘daily goods’ is also strongly represented, accounting for 24.8% of the total portfolio, in line with the Fund’s strategic focus on ‘high street retail’ and ‘district shopping centres’, or Experience and Convenience.

Portfolio composition by tenant sector as a percentage of rental income

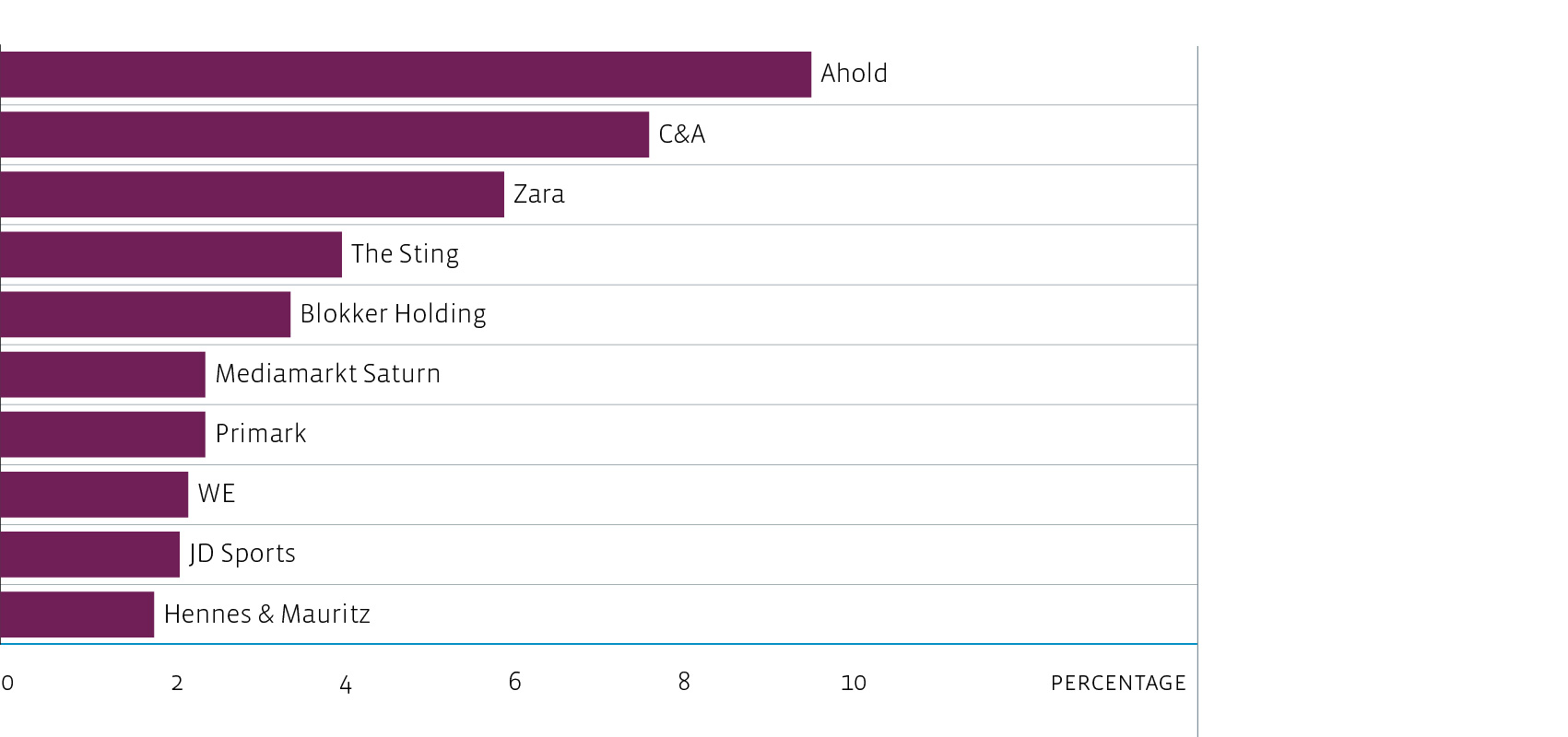

Top 10 major tenants based on theoretical rent

The top ten tenants accounted for a total volume of 41.3% of the theoretical rent in 2015 (2014: 38.8%). New Tenant Primark joins the ranking in seventh place after the completion of the redevelopment in Westerhaven in Groningen. The new retail shop will open to the public in 2016. Primark will be the Fund's largest tenant after completion of the redevelopment in Amsterdam.