Portfolio composition at year-end 2015:

16 properties across the Netherlands

212,995 m² of lettable floor space

Total value investment property € 478 million

Diversification guidelines and investment restrictions

During the financial year, the Fund adhered to its diversification guidelines and investment restrictions.

Diversification guidelines | Current portfolio | Conclusion |

≥ 80% of investments invested in core regions | 100.0% in core regions | Compliant |

≥ 90% of investments invested in low or medium risk categories | 100.0% in low and medium risk | Compliant |

Investment restrictions when the total investments of the Fund are > € 750 million |

< 15% invested in single investment property | There are two investment properties exceeding 15% (*) | N/A |

< 10% invested in non-core office properties | 7.9% concerns non-core office properties (2 public parking assets) | Compliant |

< 10% pre-finance acquisitions | There are no investments under construction | Compliant |

No investments that will have a material adverse effect on the Fund’s diversification guidelines. | There have been no investments in 2015 that have a material adverse effect on the Fund's diversification guidelines | Compliant |

(*) The total value of investment property in the Fund is € 478 million, so the restriction is not yet applicable.

Investments, divestments and redevelopments

In 2015, the fund divested a portfolio of non-core assets for € 70.5 million, which was a major step in the optimisation of the Fund’s portfolio. in the same period, the Fund invested a total of € 9.6 million in redevelopments, renovations and sustainability upgrades.

Acquisitions

The Fund made no acquisitions in the year under review.

Divestments

The Fund divested 15 non-core assets, of which one was a single asset transaction in February (Brabantse Poort, Nijmegen), while 14 assets were sold as a portfolio in December. The wall of money entering the Dutch market, largely from foreign investors, made it an opportune time to accelerate the Fund’s divestment plans for the coming years. This divestment effectively enabled the Fund to optimise the portfolio in one fell swoop and we do not foresee any further divestments in the foreseeable future, unless the pricing of any offer sufficiently attractive. Earlier in 2015, Brabantse Poort in Nijmegen was sold to neighbouring owner and occupier Bovemij.

Divestments

Asset | City | m² |

Maincourt | AMSTERDAM | 5,247 |

Maasplaza | DORDRECHT | 4,566 |

Schutterveste | LEIDEN | 5,883 |

De Geusselt | MAASTRICHT | 6,879 |

De Geusselt | MAASTRICHT | 4,390 |

De Geusselt | MAASTRICHT | 11,012 |

Brabantse Poort | NIJMEGEN | 5,848 |

De Witte Keizer | ROTTERDAM | 3,221 |

Eastpoint | ROTTERDAM | 4,929 |

Prinsenland III | ROTTERDAM | 1,296 |

ZEN Building | UTRECHT | 5,953 |

Europe Palace | ZOETERMEER | 11,296 |

Cultuurhuis | ZWOLLE | 4,443 |

Schoolkantoren | ZWOLLE | 1,720 |

Schoolkantoren | ZWOLLE | 1,720 |

Optimising the risk-return profile

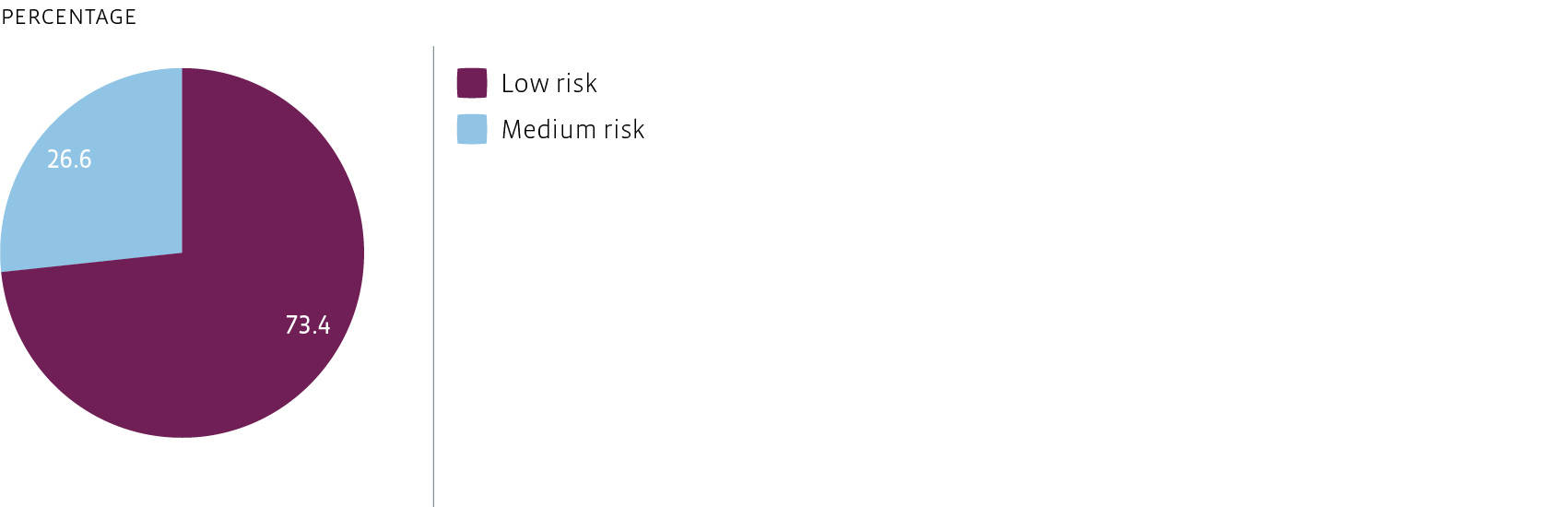

In terms of risk diversification, at least 90% of the investments must be low or medium risk.

The target risk and the actual risk allocation as at year-end 2015 are shown in the figure below. Every year, all properties are assessed separately. The divestment of 15 non-core office buildings resulted in the elimination of the high-risk category. As a result, the Fund was classified as 100% low to medium risk and as such was consistent with the framework of the Fund conditions.

Future redevelopment investments related to the WTC Rotterdam and Citroën buildings will further lower the risk profile of the Fund.

Portfolio composition by risk category based on book value

Diversification

Focus on central locations in core regions

To identify the most attractive municipalities for office investments, the Fund takes into account indicators such as:

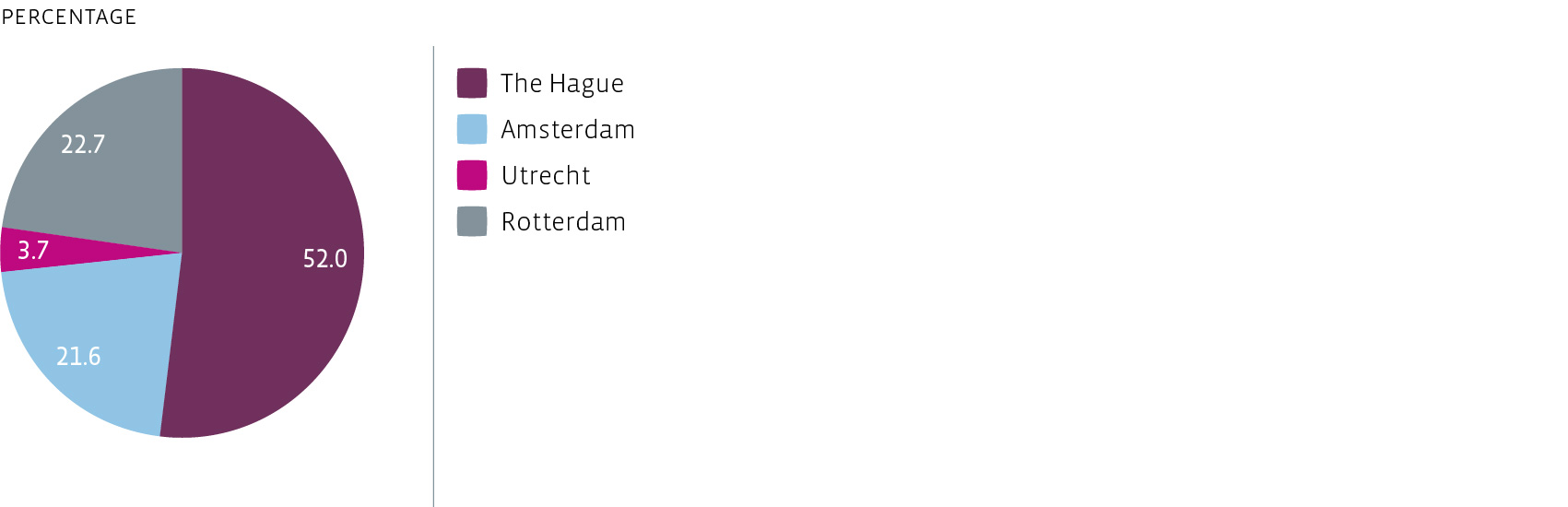

At year-end 2015, 100% of the Fund's assets were located in the four prime office regions; Amsterdam, Rotterdam, The Hague and Utrecht. The divestment of 15 non-core assets led to the elimination of investments in both non-core and secondary core regions.

The 2014 acquisitions in Amsterdam and Rotterdam improved the diversification, reducing the share of the portfolio in The Hague.

Portfolio composition by core region based on book value

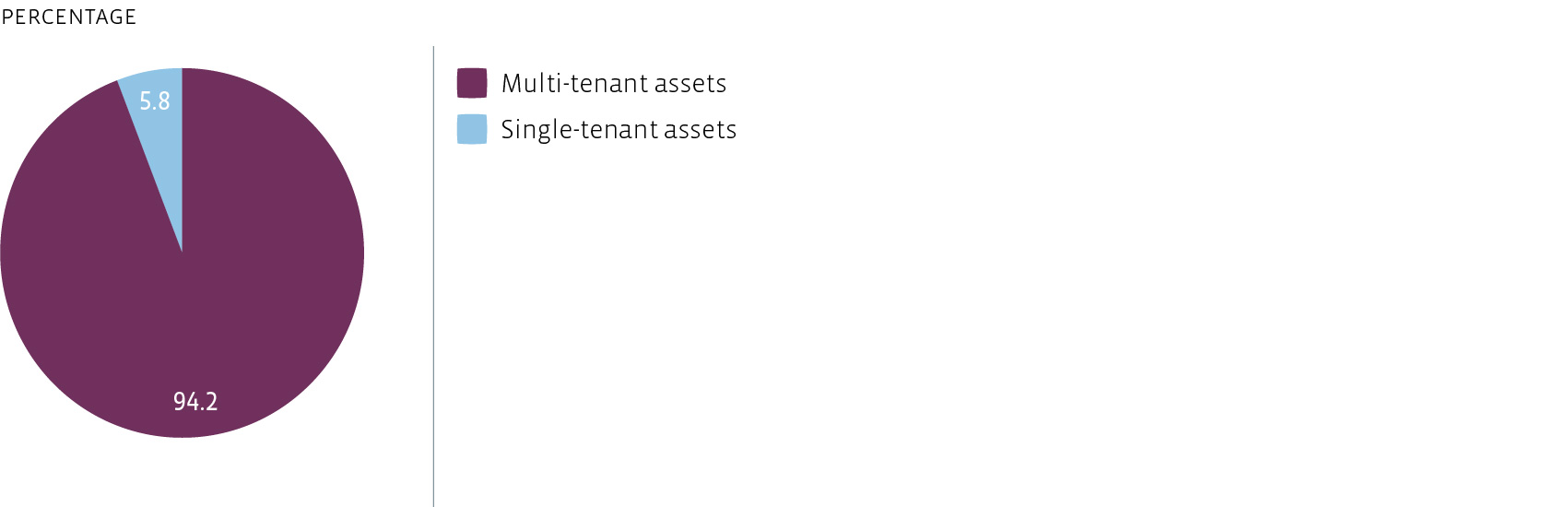

Focus on multi-tenant, multifunctional, multimodal office concepts

Multiple lease agreements reduce the volatility of revaluations and help increase the control of asset management risks. Furthermore, the Fund focuses on locations that attract a widely diverse group of people and offer a mix of culture, education, sport and work facilities.

The divestment of single tenant assets Maincourt (Amsterdam) and Europe Palace (Zoetermeer) increased the share of multi-tenant assets in the portfolio composition to 94.2% (93.2% in 2014).

Portfolio composition by single vs multi-tenant based on book value

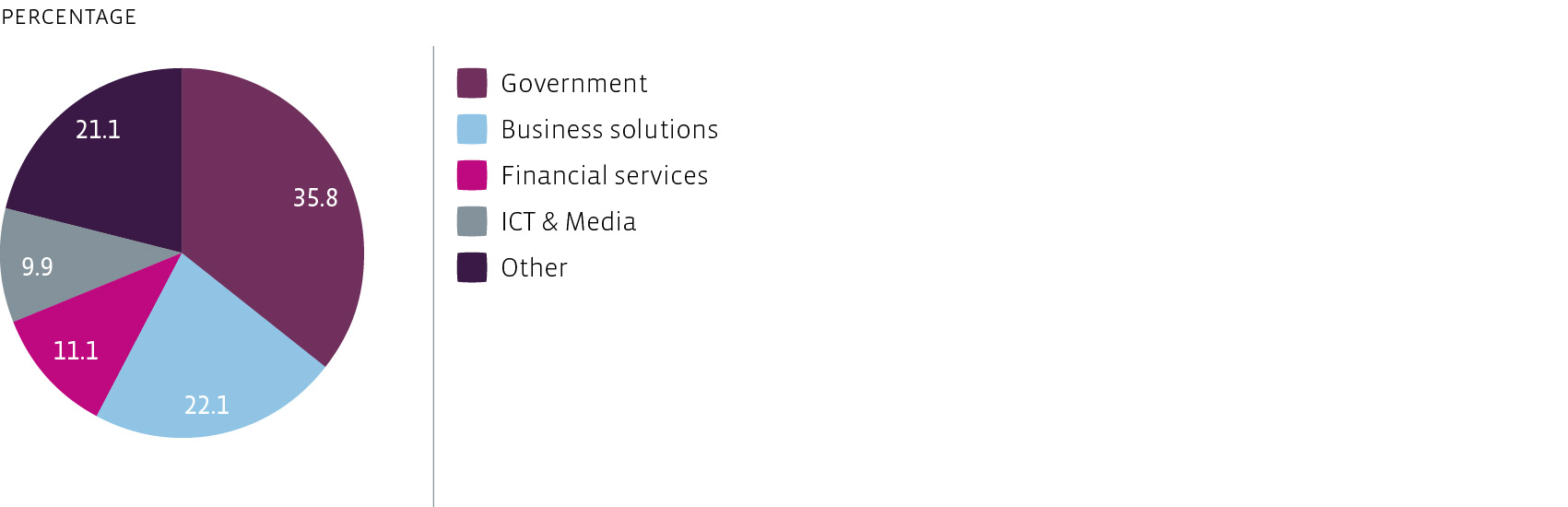

Tenant mix

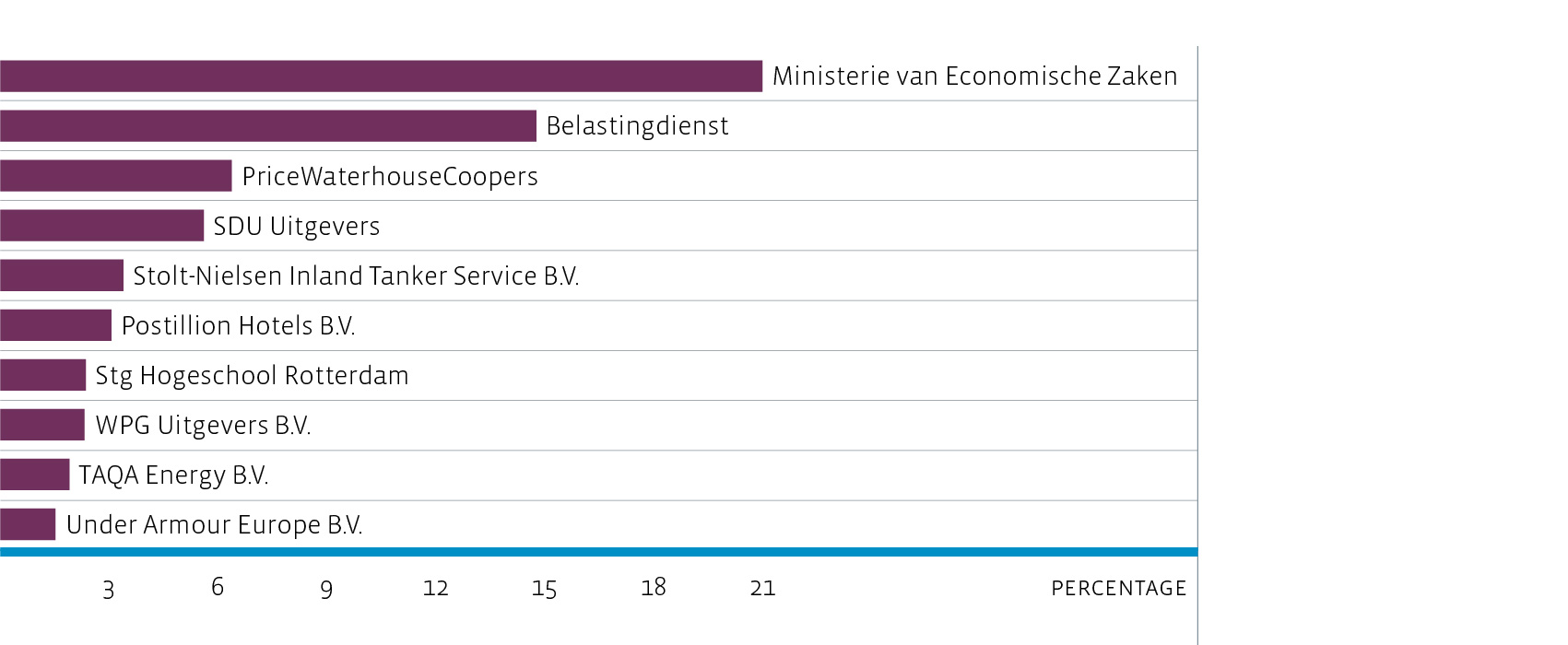

All tenants are considered to have a low debtors risk. The top ten tenants account for a total of 62.4% (2014: 53.0%) of the theoretical rent. The Fund negotiated leases with a number of new and existing tenants in 2015, closing leases for 33,965 m² of office space and annual rent of € 4.2 million. We maintain close relationships with all tenants to ensure satisfied customers.

Portfolio composition by tenant sector as a percentage of rental income

The Office Fund’s top 10 tenants

Another consequence of the divestment of 15 non-core assets is that Bouwinvest, Nationale Politie and DHL Finance Service no longer belong to the top 10 tenants. New tenant WPG Uitgevers, which leases all of the redeveloped Valina office buidling (Amsterdam) is new in this top 10. Stg Hogeschool Rotterdam expanded its leased spaces and has risen in the top 10.

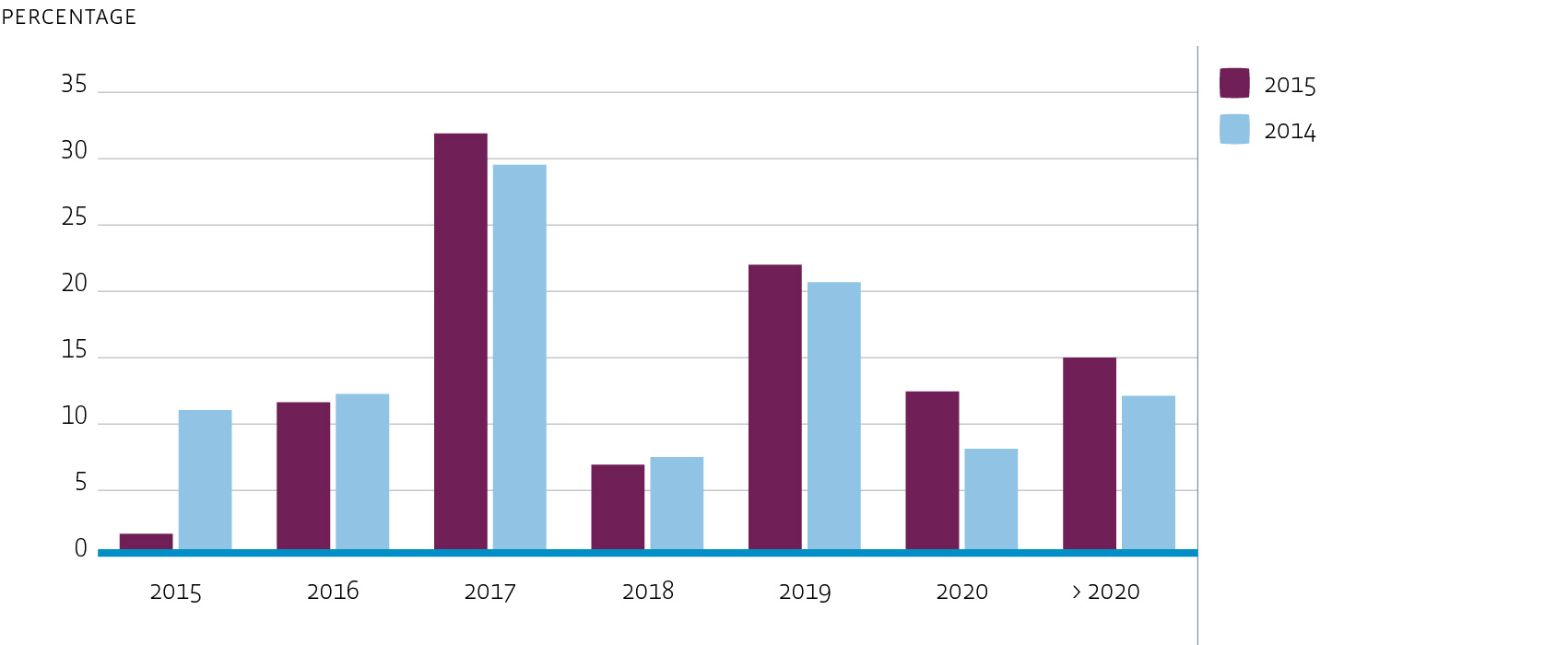

Expiry dates

The relatively high percentage of expiry dates in 2017 and 2019 is a result of the potential termination of leases with two large tenants. The average remaining lease term stood at 3.2 years, marginally lower than the 3.8 years at year-end 2014.

Close relationships with tenants enable the Fund to propose lease extensions at the right time. However, lease endings are taken into account and the Fund anticipates this to attract new tenants.

Expiry rates as a percentage of rental income

Active asset management – building value

Bouwinvest devotes a great deal of attention to maintaining high occupancy levels by developing close relationships with tenants and property managers. Thanks to its excellent customer focus, knowledge, experience and a broad network, the Fund is able to respond (pro-actively) to users’ changing requirements for office space. Thanks to this pro-active approach, in-house expertise and a focus on sustainable partnerships with public and private parties, Bouwinvest is able to add value to its assets. The Fund frequently acquires and transforms previously underperforming assets into high-quality office complexes that meet the needs of today’s – and tomorrow’s – office tenants.

WTC The Hague

WTC The Hague is a prime example of an office building of the future. Based in a multifunctional location, offering flexible office concepts and services to a variety of large and smaller businesses, WTC The Hague is a frontrunner in its region.

In 2015, the Fund initiated several measures to further optimise WTC The Hague, including the renovation of the Plaza area, to make it a more pleasant and dynamic business meeting place and improve the image and positioning of the building as a whole.

Last year, the WTC International Business Club once again teamed up with the WestHolland Foreign Investment Agency, the Dutch Council for Trade Promotion, the Chamber of Commerce and The Hague city council to organise a number of networking and business promotion events.

Citroën buildings Amsterdam

The Fund initiated preparations for the renovation and remodelling of the Citroën buildings in Amsterdam via an architect selection process. This resulted in a Provisional Design for the new multi-user business complex, based on a cost-benefit analysis for an investment proposal that will be submitted for approval in early 2016. Thanks to the iconic status of the building, plus its excellent location, we were able to arrange a number of temporary leases for pop-up art galleries and restaurants throughout the year. We are already seeing a growing interest in long-term leases for the buildings once the renovations have been completed.

WTC Rotterdam

The Fund reorganised the property management for the WTC in Rotterdam, selecting a number of new partners to realise various improvements to the building. Since Postillion’s takeover of the WTC Congress & Event Centre, business meeting activities have improved and Postillion will play a major role in the co-creation of an attractive business/meeting place, which will support new branding and positioning efforts and help increase new lettings and lease renewals.

The upgrades to the building include a new company restaurant and the addition of a roof-top bar and restaurant open to the general public. We have also initiated the renovation of the Beurshal entrance area, to enhance the image and positioning of this striking section of the building. Linking up to a thermal energy storage system in an adjacent building has also enabled us to improve the sustainability of the building. We are currently conducting a feasibility study into the possibility of converting a part of the building into a hotel.

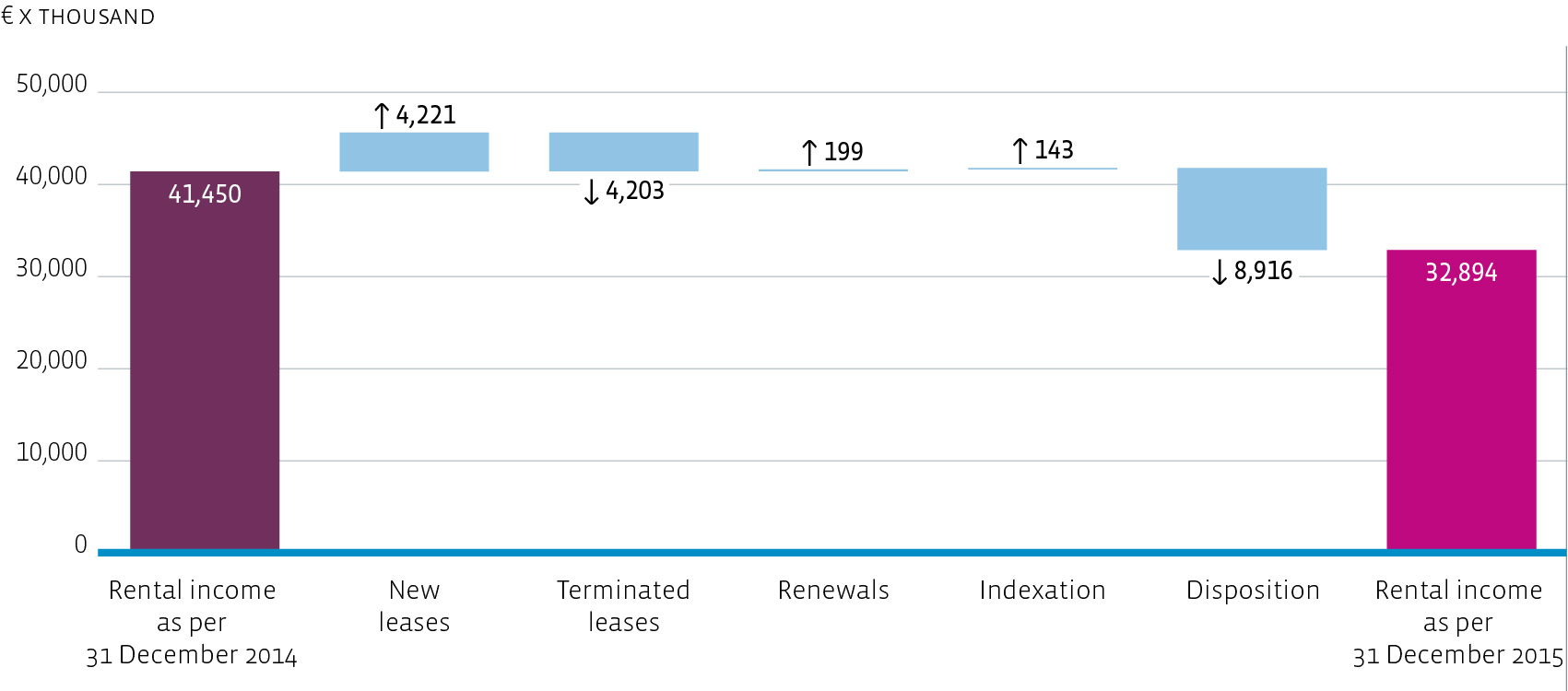

New leases and lease renewals

The five-year average outperformance of the IPD Property Index is mainly the result of active asset management, which led to a total of new and renewed leases of 33,965 m² and an annual rent of € 4.2 million.

The Fund also succeeded in signing several new leases. In many cases, these were the result of investments in refurbishments executed in advance to attract new tenants.

New and renewed leases include:

Stichting Hogeschool Rotterdam for WTC Rotterdam (5,838 m²);

WPG Uitgevers for Valina (Amsterdam, 3,716 m²);

Under Armour Europe B.V. for Olympic Stadium (Amsterdam, 1,410 m²);

Several smaller lettings for WTC Rotterdam (1,621 m²);

Several temporary leases for the Citroën building (Amsterdam, 9,205 m²);

Despite the trend towards more flexible lease agreements, most new and renewed leases are still five-year leases.

Movement in annual rent in 2015

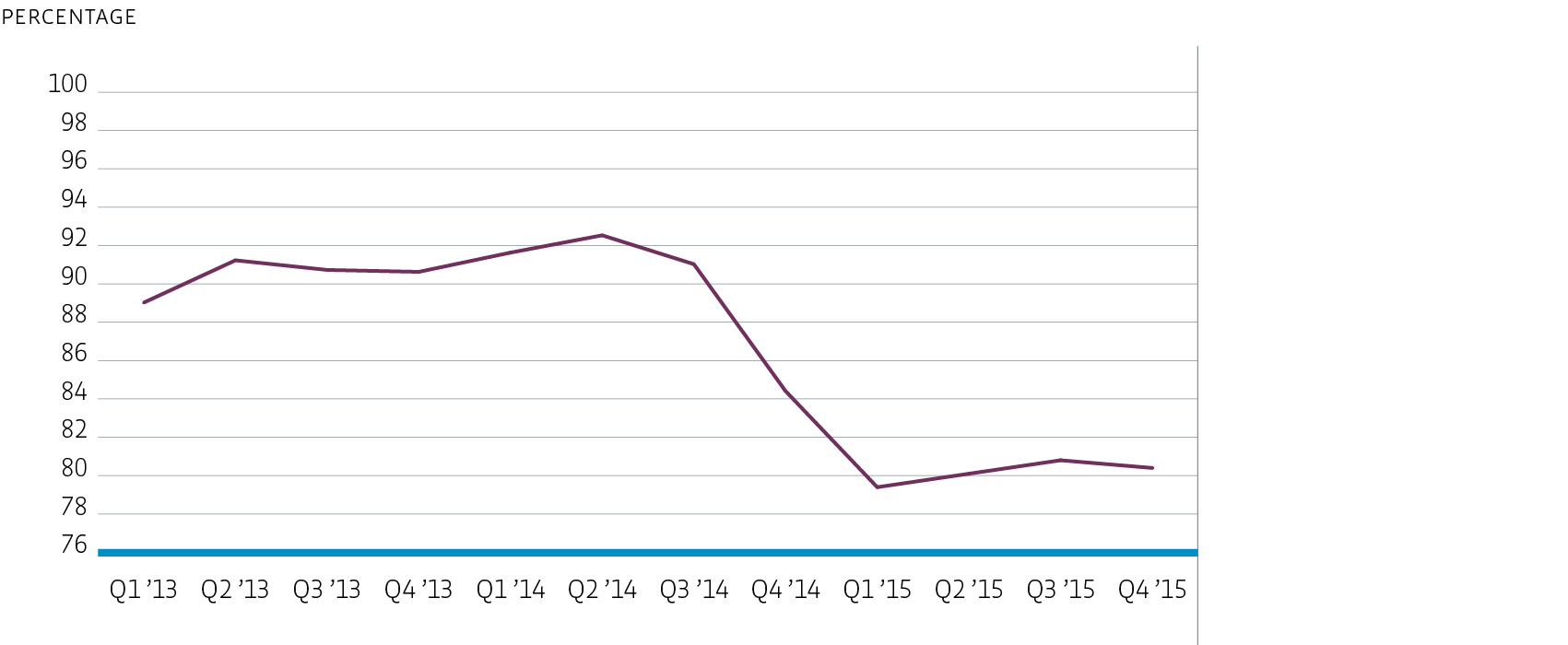

Financial occupancy

A lease with KPN for WTC The Hague (11,361 m²) ended in the fourth quarter of 2014 and these spaces were fully vacant in the first quarter of 2015. This led to a drop in the occupancy rate in 2014 and a further decrease in 2015. Finding new tenants for this building has proven challenging due to the competition on the office market in The Hague. The renovation of the Plaza area of the WTC will make the complex more attractive and encourage new leases or lease renewals. The Stichting Max Havelaar lease for Arthur van Schendelstraat (Utrecht) following improvements in the sustainability of the office building has led to a great deal of interest from like-minded organisations in the non-profit sector. The Fund is currently in negotiations on a number of leases.

The (relatively) low occupancy for WTC Rotterdam when it was acquired at year-end 2014 has led to a further increase in the Fund's vacancy rate. Measures taken in 2015 resulted in several new and renewed leases in 2015 and are likely to result in more leases in 2016. The Citroën buildings acquired in 2014 will remain vacant for the following one and a half years, while the Fund redevelops the buildings. We did negotiate a number of temporary leases for 2015 and we foresee full occupancy for this complex once the renovation is complete. We are already in negotiations with a number of parties for office space in the multi-user Citroën buildings.

Financial occupancy rate

Asset optimisation

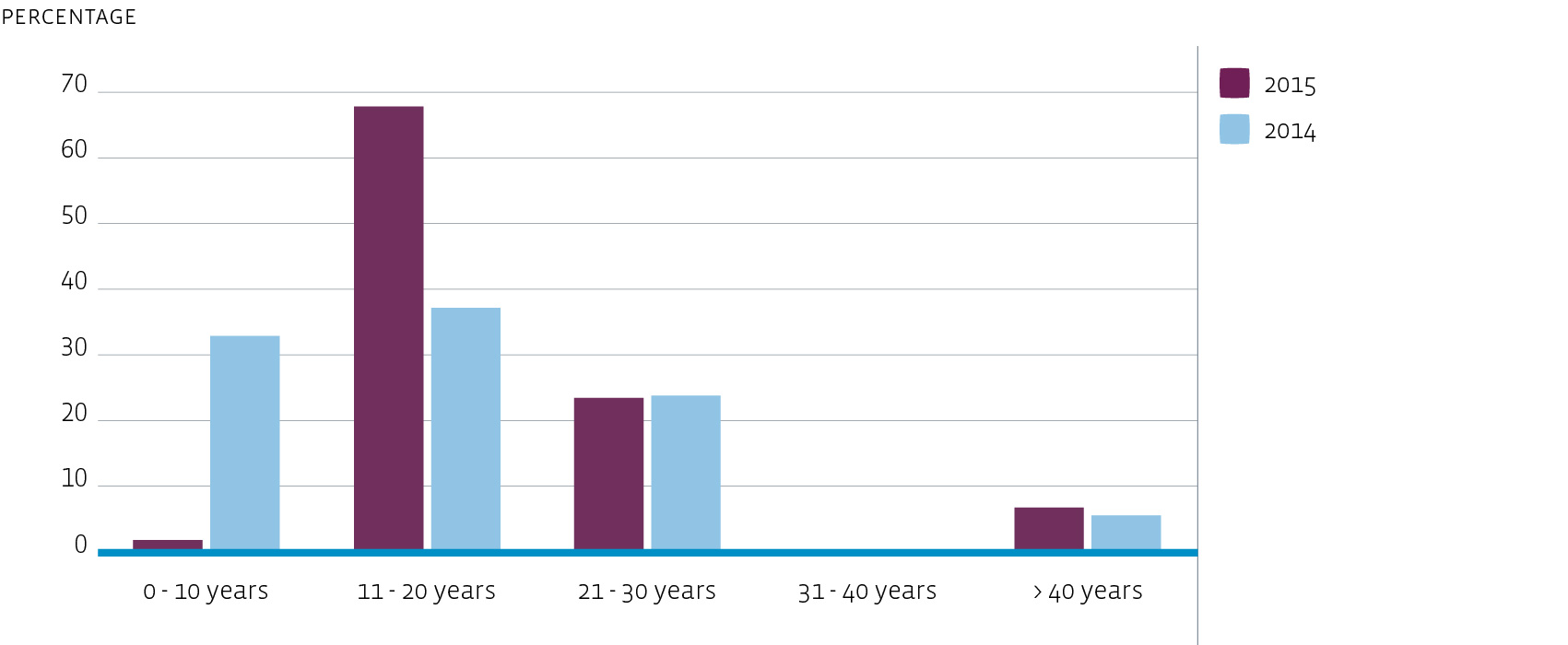

Although the buildings in the Fund’s portfolio are relatively young, a large part is now more than 10 years old. The lay-out of these buildings therefore generally needs to be updated and modernised to keep the building lettable in today’s market. The Fund has upgraded a number of empty spaces prior to closing new lease contacts. The renovation and letting of the Valina office building in Amsterdam and ongoing upgrades to the WTC complexes in The Hague and Rotterdam are perfect examples of this approach. As mentioned elsewhere, the improved sustainability of the Arthur van Schendelstraat office building in Utrecht and the subsequent lease taken out by the Stichting Max Havelaar has led to a great deal of interest in office space in this building from other non-profit organisations.

Portfolio composition by age based on book value

More important than age is the asset's distinctive character, its location and return prognosis. Following the 2014 acquisition of four existing buildings, two of which have a listed status, the average age of the portfolio has risen accordingly.

Investments in sustainability also increase the chances of new leases or lease extensions, as demand for sustainable offices is growing. These investments can also cut housing expenses, which gives office buildings a competitive edge in terms of pricing.

Area promotion

As part of our ongoing drive to forge sustainable partnerships with various stakeholders, Bouwinvest has always been involved in numerous area organisations, such as the Olympic Stadium area in Amsterdam and the New Centre project in The Hague. Bouwinvest teamed up with The Hague city council and a number other companies to found the Green Business Club Beatrixkwartier. The aim of the club is the promotion of The Hague as an attractive city and the sustainable development of the Beatrixkwartier district. The idea is to improve facilities and amenities, which will include initiatives on both social and environmental fronts. One of the first initiatives – launched in 2015 – was the transformation of an under-used parcel of land into a pop-up park for the employees of local businesses and the area’s residents.