In 2015, Bouwinvest took a number of significant steps to further integrate corporate social responsibility into its day-to-day business. The pillars of our CSR strategy are: our aim to be a reliable business partner, to increase the sustainability of our real estate investments in cooperation with our stakeholders and our goal to be an ethical and fair employer. The shift to a more refined set of CSR pillars signals a step forward in our journey of linking financial and sustainability ambitions and strategy to create long-term stakeholder value.

Dutch real estate funds win Green Star status

Bouwinvest uses the Global Real Estate Sustainability Benchmark (GRESB) to measure and compare the sustainability performance of our three main Dutch sector funds. In 2015, Bouwinvest's three main Dutch sector funds once again actively participated in this initiative, which is aimed at boosting transparency and sustainability in the real estate sector. Thanks to this strategy and the actions that Bouwinvest continued to make in 2015, Bouwinvest's Residential, Office and Retail funds were awarded Green Star status for the second year in a row. Green Star is the highest possible category in the GRESB rankings and we will be doing our utmost to retain this status in 2016 and beyond.

Sustainability hotspots

Bouwinvest is currently working on a materiality matrix to help the company identify the main sustainability issues and devise a strategy to deal with them on an ongoing basis. This is important because sustainability is about a lot more than the environment and reducing emissions. Real sustainability also embraces ethical, legal, social, compliance, risk and human resources issues.

In today’s ever more demanding environment, a CSR strategy has to address all these issues to create sustainable value for an organisation’s stakeholders. The materiality matrix will help us to further boost awareness of how important it is for us to embed ESG criteria in our day-to-day business, and help us to refine our priorities and targets. It will also act as a starting point for further engagement with several relevant stakeholder groups in 2016.

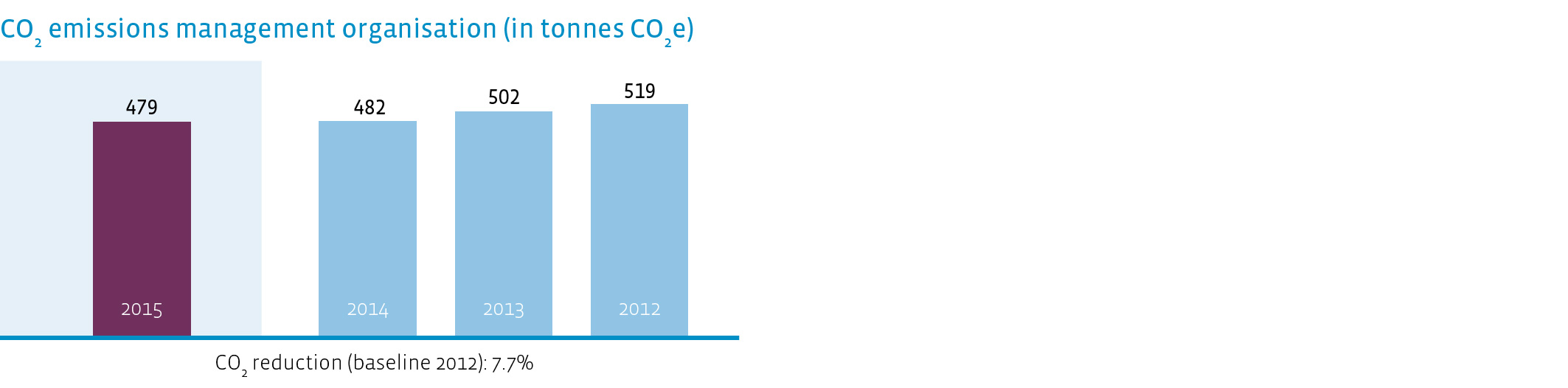

CO2 footprint Bouwinvest organisation

In 2012, Bouwinvest started to improve the transparency of the management organisation's CO2 emissions. A year later, we expressed our ambition to make our operations carbon neutral by 2020. We have already made significant progress in reducing our emissions in recent years and we took further steps to reduce emissions in 2015. Progress made this year include:

Electricity consumption in our head office fell by another 9% in 2015; totalling a reduction of 37% since the start of active energy management in 2010.

Emissions from our waste disposal fell by 11%.

The use of more fuel-efficient lease cars (including hybrid and electric lease cars) resulted in a reduction in CO2 emissions of more than 2%, while the number of kilometres driven increased by 4%.

A side-effect of an increase in our international real estate allocation was a 14% increase in CO2 emissions from air travel.

These and other measures led to a total reduction in our total CO2 emissions of 0.6% compared to the previous year. Carbon emissions intensity, calculated as tonnes of CO2 /FTE dropped by 2.9%. In addition, Bouwinvest purchases renewable energy (electricity) for its entire real estate portfolio. This is part of Bouwinvest’s policy to reduce any negative impact on the environment and stimulate the use of sustainable sources of energy.