Our CSR pillars

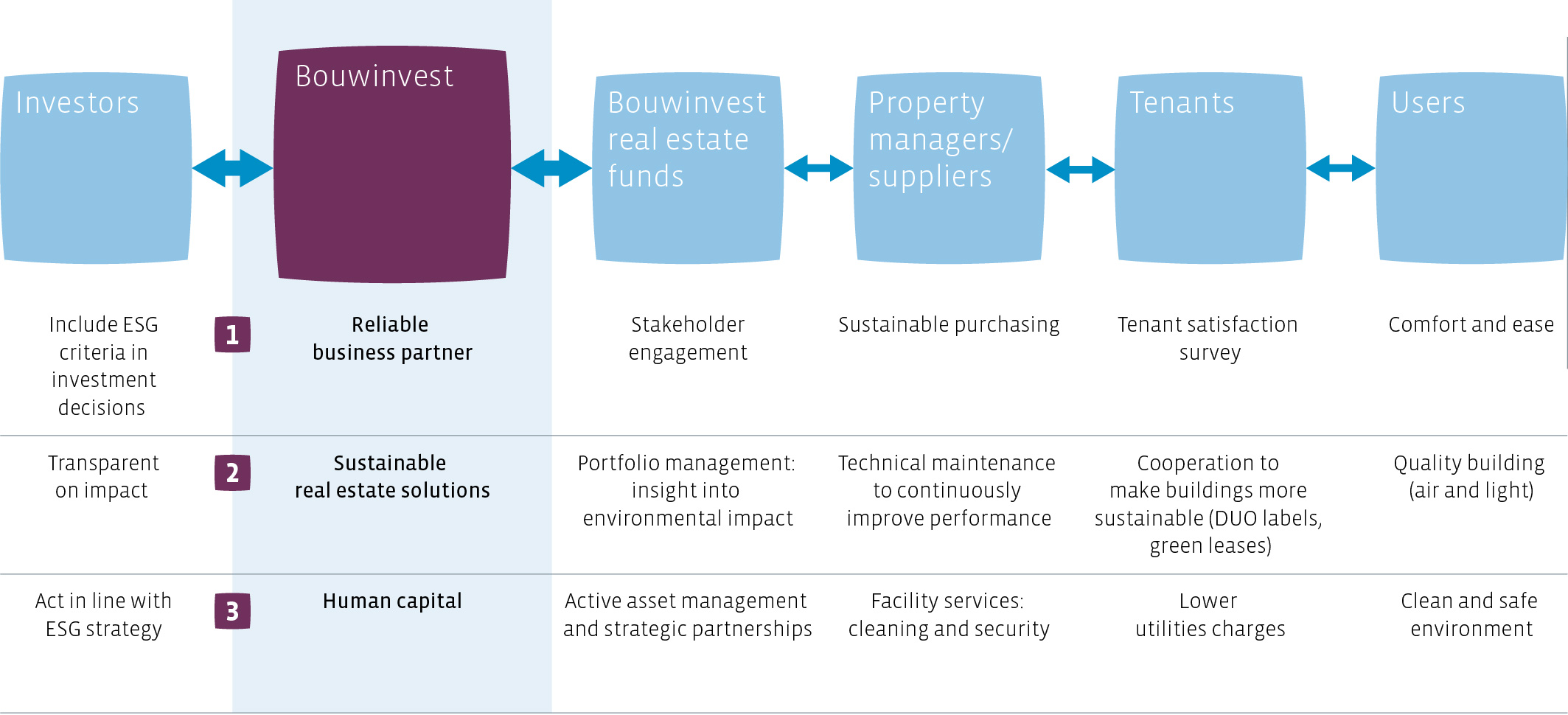

Bouwinvest has divided its CSR mission and activities into three pillars:

We aim to be a reliable business partner and meet the expectations of our investors through full transparency on our CSR track record and goals.

We endeavour to continuously improve the sustainability of our investment portfolio in cooperation with all our stakeholders.

Our goal is to be a flexible, ethical and fair employer to help our people to achieve Bouwinvest’s CSR ambitions.

Sustainability strategy and material issues

Sustainable and reliable business partner

Bouwinvest sees sustainability as an integral part of its business and we believe that transparency on where and how we impact society is a key element in improving our sustainability performance. This transparency gives us invaluable insight into the issues relevant to us and to our stakeholders, and enables us to define clear priorities and set concrete and measurable targets.

We believe that the best way to ensure that our CSR strategy is effective is to form sustainable long-term partnerships with our business partners. These organisations play a vital role in our daily operations, and ensure that our assets remain clean, safe and vibrant places. We set strict requirements for our third-party suppliers and assess their performance regularly via Bouwinvest customers. We also forge long-term business partnerships with other stakeholders, such as our investors, in which we protect the interests of our clients by conducting our business in a transparent, fair and ethical manner, avoiding all forms of corruption and unethical conduct, while providing stable and sustainable returns on their investments.

See the Corporate governance section in this report for more details.

Sustainable real estate

Bouwinvest is constantly improving the transparency and sustainability performance of its three main sector funds, both at a bricks and mortar level and at fund level. We use globally accepted performance indicators (INREV, GRI) and sustainability labels (GRESB, BREEAM) to benchmark our performance and our progress. However, it is impossible to achieve real sustainability by yourself.

See the CSR sections of the Fund annual reports for more details.

Benchmark international real estate investments

Last year, Bouwinvest also continued its active cooperation with other institutional investors aimed at increasing sustainability and transparency in the real estate sector. We extended our membership of GRESB and encouraged fund managers of our (international) indirect investments to participate in the GRESB benchmark.

In 2015 we assessed the effectiveness of our Responsible Investment Property Policy. We received valuable input from our international real estate investments to evaluate and further enhance our policy and increased our understanding of the challenges and opportunities in the real estate sector regarding responsible property investment.

The results of the GRESB benchmark once improved in 2015, despite a slight drop in response rate in the yearly assessment.

Highlights GRESB and international portfolio:

The number of investors participating in the GRESB benchmark dropped slightly to 65% from 68% measured by NAV.

The number of Green Stars increased to 18 from 15 (unlisted investments) and rose to 21 from 18 for listed investments. This means that the number of Green Stars overall has more than doubled since benchmarking started.

The international portfolio outperformed the benchmark, with an average total score of 59 compared with a global average of 55.

The score increased considerably throughout the portfolio. For the unlisted investments, 91% improved their score compared to last year (in 2014: 43%). For the listed investments, the increase was also impressive: 78 %, following an increase of 54% in 2014.

The unlisted investments participating in GRESB delivered a 3% overall decrease in energy consumption (80.531 MWh) and a 3% overall decrease in GHG emissions (18.841 tonnes).

Sustainability performance is one of our key criteria in investment decisions and risk assessment, and we give a clear preference to investments with higher sustainability scores. The inclusion of the corruption index per country and the RobecoSAM country sustainability index in our internal Bouwinvest Global Market Monitor also enables us to assess and manage ESG risks even more effectively when selecting our international investments.

For more details, please see the CSR sections in our fund reports and the CSR performance indicators in this annual report.

A sustainable, ethical and fair employer

Bouwinvest sees its employees as its most valuable resource and its most important source of value creation. Our HR policy is aimed at providing our employees with the knowledge, expertise and skills they need, so they can develop their talents, expand their skill sets and help create a pleasant and stimulating working environment. The results of last years' employee engagement surveys show that this approach is working. For the past three years, Bouwinvest has booked a steady improvement in what we see as a one of the main spearheads of our HR policy. No less than 95.5% of our employees responded to the 2015 survey, which is more than 15% more than the benchmark of 80.5% for financial institutions and way above the national average of 70.8%. This demonstrates a remarkably high level of engagement on the part of our employees. This was confirmed by another rise in our employee engagement score to 8.0, compared with 7.8 in the 2013 survey.

For more details, please see the HRM section in this report.