The primary focus of the Fund is on stable income return through solid real estate investments in growing and stable segments of the Dutch healthcare market.

To summarise:

Core investment profile

No leverage

Growth strategy (€ 300 million end of 2018)

Target long-term average annual Fund return 6.5%

Focus on distinct healthcare segments in the Netherlands

Regional diversification based on a positive economic and demographic outlook

Rent increase: inflation linked

50/50 master lease and individual lease

CSR integral part of the Fund strategy

Focus on core regions

The regional focus is mainly on the ‘mid-west’ of the Netherlands, as can be seen in the figure below. The selected municipalities have strong foundations based on their demographic and economic outlooks and the real estate market, for both the elderly and the mentally disabled.

Core regions Healthcare Fund

Investment assumptions

A defined set of Investment Restrictions is used in the execution of the Fund’s strategy. The Fund will adhere to the following Investment Restrictions to focus on its core activity and to limit risks:

Target guideline diversification: At least 80% of NAV within core regions

Target guideline lease structure: ≈ 50% (of NAV) master leases

Sustainable partnerships with solid operators a key factor in success

Especially when a master lease is involved, sustainable partnerships with solid operators are key factors in the performance of real estate. Operators need to be in good financial position, have a clear vision of the future needs of their target group and of how to manage corporate real estate (decisions on ownership versus lease for instance), provide solid guarantees and - preferably – have a good track record if they are to meet the obligations of a long-term lease. In 2015, Bouwinvest conducted due diligence on three healthcare providers with whom we are involved in more than one transaction. Following a very thorough due diligence process, we now have confidence in the business model of these providers. As a result, we expect to complete future transactions with these providers related to new assets in the portfolio much more quickly in the future.

Three focus segments within healthcare market

Selected healthcare segments: Care market

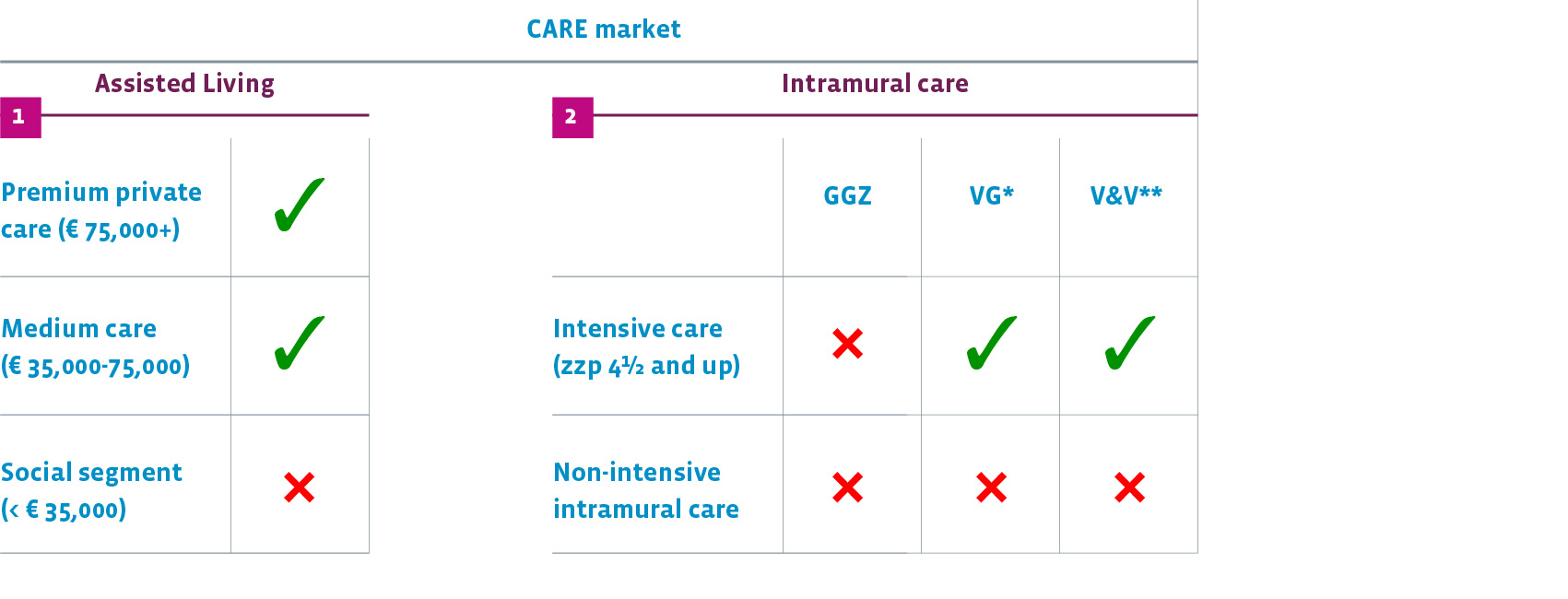

We focus on growing and stable segments: the elderly care segment and the mentally disabled segment. Within care, we have identified two segments: Assisted Living and Intramural Care:

1. Assisted Living

Due to the separation of housing and care, there will be a major increase in demand for high-quality care residences, a segment in which Bouwinvest already has a great deal of experience. Assisted Living includes two sub-segments. The first is the mid-segment for consumer incomes of between € 35,000 and around € 75,000. This pertains to the liberalised rental sector, with lease prices of more than € 711 per month. Services and care are optional and the rental combines a modern, ‘care ready’ apartment with care facilities ‘within arm’s reach’. The second is the premium segment for people with earnings of € 75,000 and upwards, which offers an all-inclusive arrangement, which combines housing, living and care.

2. Intramural care

This involves intensive care for elderly (retirement homes) or mentally disabled people for whom it is no longer possible or safe to live in their own homes. This segment is growing strongly and people will not be left to their own devices in the Netherlands, making this an interesting segment for institutional investors.

The Fund directs much attention to assure the continuity of operations of the tenant. As a result of the changes in the funding of the care system in The Netherlands, the financial situation of many healthcare providers is not completely at the desired level yet. The fund performs extensive internal due dilligences to assure that both current and future financials are sufficient to continue operations. Furthermore, the Fund only acquires intramural real estate that is attractive to other healthcare providers, so that new tenants can be found quickly in case of bankruptcy. And lastly, all assets are designed in such a way that they can easily be transformed into regular apartments by combining two or three intramural appartments to one single appartement.

- *Care for the mentally disabled (verstandelijke gehandicaptenzorg)

- **Elderly care (verpleging & verzorging)

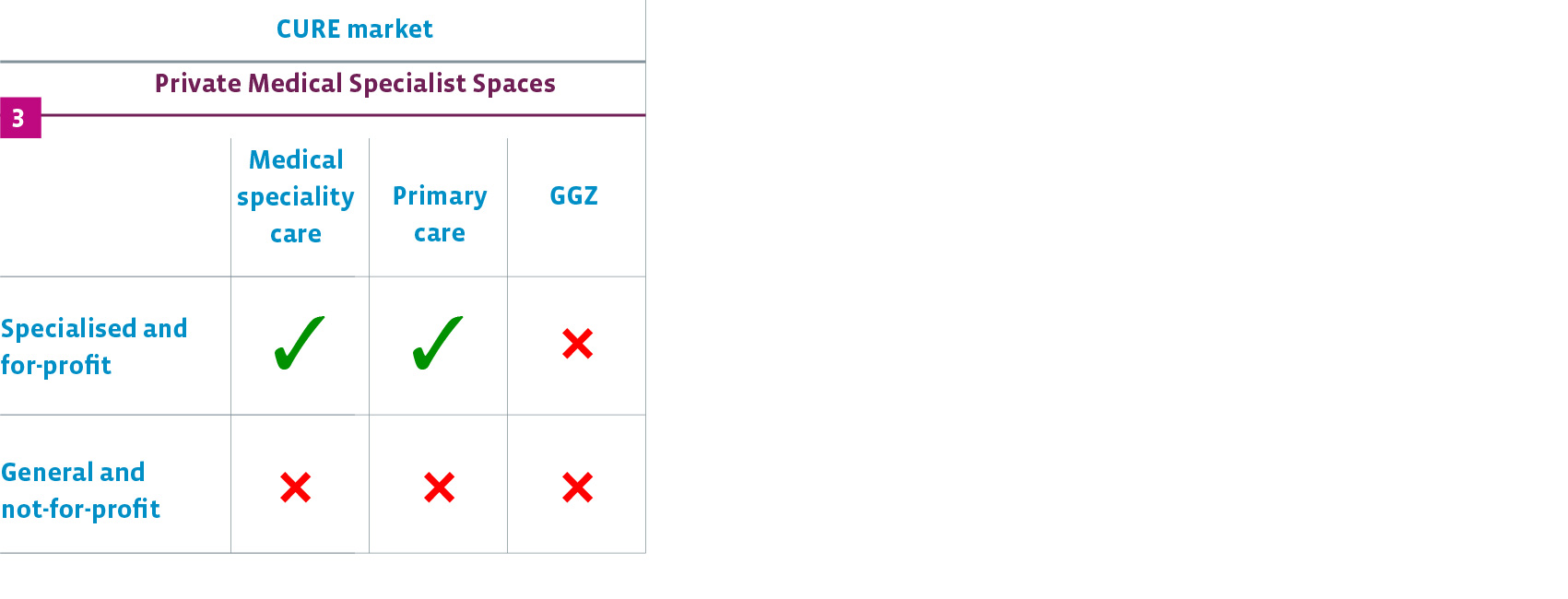

Within the cure market, we also focus on growing and stable segments. However, another criterion is that we only invest in the for profit segment:

Privately owned specialised clinics (that specialise in certain types of surgery, such as knees, eyes, skin, etc.)

Primary care: family doctors, physiotherapists, dentists, etc. (healthcare centres)

We exclude general hospitals, as these institutions currently have trouble maintaining in control of costs and revenues, due to changing government policy.

For all segments, we exclude the GGZ sector (psychiatric help) due to the negative outlook for this segment, as there are large budget cuts forecast for the coming years.

Core profile of the Fund

Based on extensive market exploration of market propositions and elaborate discussions with appraisers, hurdle rates are defined for the risk categories Core-, Core and Core+. The components of the hurdle rates are:

The risk categories each have their own minimum required returns (hurdle rates) on the basis of which assets are acquired. The hurdle rates are evaluated periodically and updated on the basis of the input of macro and micro economic developments. However, as a result of the market circumstances, acquisition opportunities could arise outside the set hurdle rates, due to specific local circumstances (hurdle rates are based on nationwide and/or (non-) core region parameters).

Target risk profile

The table below gives an overview of the target spread within the various segments.

Risk/segment spread | Core minus | Core | Core plus | Total |

Assisted Living | 15% | 15% | 20% | 50% |

Intramural care | 15% | 25% | 0% | 40% |

PMSS | 0% | 10% | 0% | 10% |

Total | 30% | 50% | 20% | 100% |

The main focus of the Fund is within Assisted Living, the segment based on the separation of housing and care. This is also the segment with the highest growth forecast, closely followed by the Intramural segment (e.g. dementia and mentally disabled).

Breakdown of the segment Assisted Living

Within Assisted Living, there are two sub segments. The first is the medium segment for consumer incomes between € 35,000 and approx. € 75,000, where services and care are optional. Rental levels are between € 711 – 1,400 per month for this segment (liberalized segment).

The second is the premium segment for incomes of € 75,000 and upwards, which offers an all-inclusive arrangement combining housing, living and care.

Healthcare property characteristics

The Fund invests in properties that have the following characteristics:

There is a master lease with a healthcare operator for the object, and/or:

The destination of the land is ‘Social (with care)’

The diagram below shows how investment decisions are made: